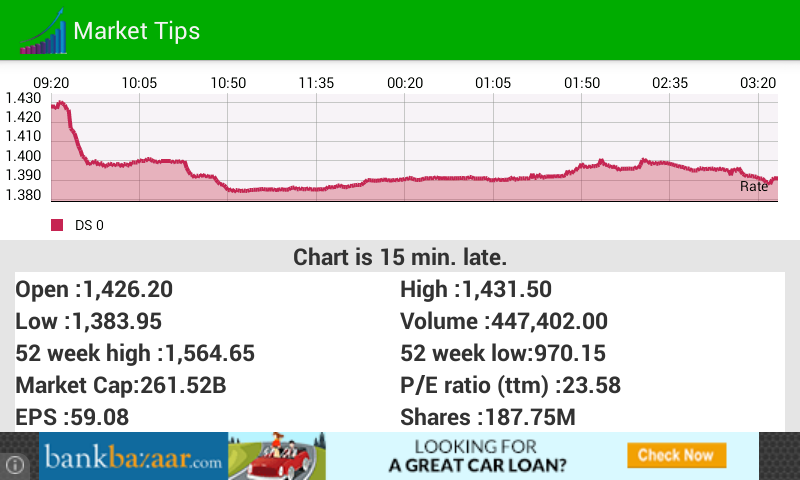

Capm indian stock market tips free on mobile

It sounds simple, but getting this wrong may jeopardise your chances of passing the interview. Date, time, and length of the interview. Ask whom you will be talking to.

This will help your preparation. As a rule of thumb: It would be unacceptable to run out of battery during a call. Make sure you are in a quiet space and undisturbed. Abraham Lincoln once wisely said: Do not ask about money or working hours,obviously.

Identify all potential questions that will be asked and practice your answer out loud. This will help make you sound more confident on the phone and will leave a good impression. Also remember to speak slowly and clearly, especially if you have a foreign accent. Except for the assumptions and maybe some basic headings, the file will be totally blank.

Investment Banking interviews typically start with a battery of questions about yourself. All those questions you will get in the investment banking interview have a single purpose and are trying to assess Adaptability, Analysis and Problem Solving, Commercial Awareness, Communication, Decision-Making and Judgment, Influencing and Persuasiveness, Leadership, Motivation, Relationship-Building and finally Teamwork. Good strengths include being a hard worker, analytical, curious, being a good communicator, a good team player, resistant to stress, don't give up easily.

Characteristics not to mention: The best examples are where you had to make a lot of effort, either hard work or team achievement. You can use sports, major study projects, or personal travel.

The least proud achievements can be any kind of failure, but you need to show that you have learnt from that failure. See strengths and weaknesses. What steps did you take? What obstacles did you encounter? How did you overcome the obstacles? How did it make you feel? Don't say, "It was the best"! Just mention classes, location, extra-curricular clubs, etc.

Fpdf pdf output options and also capm indian stock market tips free on mobile

Answer can be that you grew up in an interesting place or an interesting experience you had. Just add examples saying that you enjoy participating competitive activities such as sports, events, etc. Describe a time of working under an intense time pressure or deadline.

How did you handle it and react? How did you handle it? What was the result? How do you prioritize projects and tasks when scheduling your time? What was your role? To whom did you make the recommendation? What was your reasoning? What kind of thought process did you go through? Was the recommendation accepted? The other one does not work hard at all and sometimes not in the office, however, his performance has been outstanding.

If you were the manager, what would you tell those two people during their performance review? How did you do it? Did they accept your idea? Knowing what you know about yourself, what would concern us most about you?

What proportion did the Terminal Value contribute to the Enterprise Value? What concerns are there? When does a hostile deal make sense? What percent of hostile deals are completed by the buyers who started the process? Why and when would you use one versus the other? Give me the calculation formula. Every line item on the income statement showed the same value for both years, but the numbers on the lines in the cash flow statement are different for the two years.

Speculate on a few things that may have happened to cause this outcome. Aptitude tests are online or written tests given by investment banks that consists of a combination of numericalverbal and logic questions. You will almost always be asked to do those tests online first once your CV has been shortlisted by banks.

Once you pass those tests and are invited to come to the assessment centre, you will be usually asked to take them again on a piece of paper which is sometimes more difficult or longer. Each year, tens of thousands of students apply to investment banks.

Those tests are a way for investment banks to make a first selection in their large applicant pool. They usually have a cut-off or minimum pass grade that students need to meet or exceed in order to go to the next stage of the interview process. Do not underestimate those tests, even if you are doing extremely well at school.

Those tests can be notoriously difficult, especially under stress, and will demand a great deal of preparation. Indeed, it would be a shame to fail an interview because of something that is in your control!

In fact, the main reason why so many students fail investment banking interviews is due to the lack of preparation or overconfidence with regard to those tests.

The tests are generally provided by SHL, an organisation that creates those tests; usually, there are three kinds of tests. In a numerical reasoning testthe examinee is required to answer questions by using information presented in statistical tables and graphs.

Questions are given in a multiple choice format. In SHL verbal reasoning testsyou are usually presented with a passage and required to evaluate a set of statements by selecting one of the following possible responses. In the course of these tests you will be asked to recognize patterns that are presented by series of shapes and thus induce and predict which shape should come next in line. JobTestPrepa UK website, does a good job of helping students prepare for those tests. Below is a detailed list of headhunting and recruitment firms that operate in the field of investment banking in London.

Sister firms, one catering for junior and middle management Argyll Scottand the other focused on executive search Redgrave Partners in Private Equity, Corporate Finance and Corporate Development disciplines. Clients include large cap LBO funds, mid cap, growth equity and distressed turnaround funds. Corporate finance coverage includes Mergers and Acquisitions, Private Equity, Corporate Broking, Equity Capital Markets and Debt Capital Markets in Investment Banks, Funds, Advisory Boutiques, Brokerage Houses and Accountancy Firms.

Equities clients include investment banks, regional specialists, mid-cap security houses, boutique brokers, specialist brokers, agency brokers and execution only houses with the team focussed on equity research,equity sales.

Fixed Income coverage includes Credit, Bonds, Interest Rates and Derivatives. Dedicated stand alone Investment Banking team with a track record and experience of the sector for over twelve years. Typical mandates at the Analyst to Director levels. Mandates are focussed on the UK and wider EMEA space.

Partnering with clients on trends in the Investment Banking market including compensation trends Analyst reportanalysis of strategic and cultural differences between Banks and up to date knowledge of hiring patterns. Started with the vision to fill a perceived gap in the market for a mid level contingency firm with the service ethos of an executive search firm. Our experienced Consultants joined Austin Andrew to establish lasting and mutually beneficial business relationships with our clients.

We strive to develop a long term understanding of our clients built upon trust and integrity, and we always aim to exceed expectations. Clients include large cap LBO funds, Mid cap, Growth Equity, Debt Funds, Venture Capital Trusts, Corporates, Advisory Boutiques, Investment Banks, Private Banks and Hedge Funds. Focuses on debt, equity and derivative sales, trading and research; wealth management; financial management, operations and middle office; credit and market risk and private equity.

Dartmouth Partners recruits individuals with an outstanding academic or professional background into firms who recognise that a competitive edge is gained by finding and hiring the best human capital available. They work with candidates broadly from years experience.

Greenwich Partners are a search and selection firm focused on Buy and sell side equity research, Private Equity, credit and debt investment funds, asset management, alternative investments such as fund of funds and secondaries and corporate development and strategy. The firm focuses on targeting candidates from strategy consulting firms, research houses, investment banks and other private equity or investment firms.

Most of their work is at the Analyst to Director level. Broad-finance recruitment firms with strong relationships with most investment banks and boutiques. Purely specialised finance-focused search firm with broad coverage across both buy and sell side, with strong relationships with many investment banks and PE funds. Global Financial recruiter covers US, Europe, Asia and Middle East that focuses on any function in financial institutions. We recruit from Senior Analyst through to Managing Director level and have been selected on numerous occasions as the Managing Agent for multi-vacancy assignments.

Would like to add your firm, contact name or anything else to this list? After having gone through all the online tests, case studies, presentations and the whole investment banking application process, the last five or ten minutes of your interview will always end with "do you have any questions for me?

While this part of the interview is not the most critical one, many applicants still manage to destroy their chances by asking the wrong questions, or not knowing what to ask. Our base advice is to keep the questions fairly simple.

While asking a very smart question will probably not be the key factor that will get you the job, asking an overly complex or inappropriate question will definitely hurt your chances of getting hired. Therefore, do not try to be the most original or smartest applicant by asking overly engineered questions. Here is a selection of the most appropriate questions to ask:. We strongly suggest not to go beyond those categories to limit potential damage.

Questions to not ask are as follows:. Typos and grammatical errors simply show that you did not spend enough time on your CV, and therefore, you do not take your applications seriously. This goes together with the first point. Do not forget that a CV is meant to be an advertisement for yourself. Expand in detail the relevant experiences, and delete entirely what does not sell you best.

Note that this also works for any other kind of experience. Also, remember to limit your resume to one page only. For instance, "I analysed the financial reports of company xxx. I compiled the reports. These are good action verbs for investment banking: This mostly relates to projects in investment banks. If you would like your CV to be reviewed by AskIvy, please see our CV Review Service here. One of the most common questions that gets asked here is this: These are the tips we gathered from a "Goldmanite", who spent 16 years at the firm: Firms like Goldman can afford to be very picky, and they hire only the best and brightest.

Keep current on world events. Play in a band. Act in a play. Subscribe to the Wall Street Journal or Financial Times, and read at least the front page every day. Understand how companies market, sell, and produce goods; understand finance and accounting. Also, an MBA will really help.

Within your extended network, there is someone who has been successful in business: Call them and ask for advice. If they are well-connected, they might even provide the most valuable help of all: This is the absolute best way to get your foot in the door. However, this is the most important part. DO NOT CONFUSE MONEY WITH HAPPINESS. I decided that I wanted money, so I set a course to get it. If you sincerely have a passion for investment banking, go for it. The recommended Goldman Sachs reading list that we have compiled below this is the list they hand out to incoming investment banking employees is one of the most comprehensive finance reading list that probably exists.

This is an extensive library covering a lot of aspects of investment banking - from the history and culture to specific areas in trading or corporate finance. You will be given some information about the clients; your task will be to answer those questions, and justify the advice you would give to the client. Most case study exercises happen during the assessment centre day, i.

Occasionally, some banks give candidates the case study materials beforehand and you will have some time usually one night to prepare. Interviewers want to put candidates into a "real" business environment to test their capability of handling real work. That is why a case study usually weights much more than any other interview or test during the investment banking recruitment process. Client A wants to get your opinion on which company they should acquire from four companies and why Company B needs to raise capital.

They come to you and ask if they should raise debt or equity, and the best way to do it. Company C approaches and asks you whether they should expand through acquisitions, or organically?

There are only few ways to practice case studies: The harsh reality is that most big banks will discount anyone without a 2. Banks receive so many applications that they have to find methods to make a selection, and the first selection is based on academic performance. All is not lost. There are a few ways that will allow you to get into big investment banks, even though this can be difficult initially. Here are a few commonly suggested routes:.

This is the ideal scenario if you studied something other than finance or business for your first degree. Often, this will be sufficient to mitigate your poor performance. When applying to banks, make sure you highlight some mitigating factors for your poor undergraduate performance.

In our view, this is a mistake, because such transfers will be highly unlikely. Therefore, we encourage you to apply for lower-tier institutions that may overlook a weak academic performance. That includes banks such as HSBC, RBS, Commerzbank, or Santander. These banks do not receive many applications compared to Goldman Sachs and Morgan Stanley, and also London investment banking boutiquesfor which we have compiled an extensive list. Those smaller banks tend to focus on some niche areas such as technology, retail, or natural resources sectors.

Sometimes they focus on smaller deals or specialised transactions, and include HCA Saavian, Piper Jaffray, Evercore, Moelis, Oppenheimer, Thomas Weisel, Brown Brothers Harriman, William Blair, etc.

This will be your chance to move into top investment banks. Many bankers did not start as an analyst from the graduate scheme. Banks typically specialise in Industry groups technology, retail, healthcareand therefore industry experience is highly sought after. Life as an investment banking analyst is very hard, so it may not be in your best interest to directly enter into investment banking. There is one way to skip this step: Therefore, one solution to poor academic performance would be to do something that you truly enjoy for two or three years work for a corporation, a non-profit organisation, start a businessexcel at it, and prepare yourself for a top MBA.

A top MBA on your CV will essentially give you a shot at all the best investment banks, without the pain of a three-year stint as an investment banking analyst! This strategy is often very effective. Many students believe that having a degree unrelated to financewill hurt their chances of getting an interview with London investmentbanks.

In your early days as a junior banker, your job will be all about the numbers. Are you a Computing Science major?

Good for Industrials clients and covering chemical companies i. Be prepared to answer the question: Try to practice with native English speakers. If your university is the best or among the top in your country, say so. Having said that, giving too many details will bore them. Keep reading the news Wall Street Journal, Financial Times, Bloomberg News, The Economist etc. For example, "I love Barcelona" is better than "I don't like Real Madrid".

Useful ways to ask for clarification are, "Could you please clarify your questions? Most employers are looking for diversity of thought, languages and experience. There is no engineered answer for this, but, based on our experience of interviewing candidates, the best answers are: Investment Banking is a challenging career and you will indeed learn a lot through the experience.

Investment banks attract top candidates from the best schools all over the world. Several candidates do have a genuine passion for finance and investment banking. If this is your case, make sure to stress this. Many bankers love their jobs because they have a visible impact on society and industries. You will need to substantiate with hard facts why you think it is interesting.

Nevertheless the answers above are just "valid" ones. My on the topic is that you should add a personal touch by using a personal "story". Your friend, family member or alumnus, who works in an investment bank, inspired you. The investment banking world is a very, very small world. This is good because it shows your interest, but it also shows that you are competitive. Again, don't make this up, as many bankers like to check.

Do you think the transaction makes sense? What you need to show is that you like dealing with a lot of numbers. Bankers are well-known to have a short attention span. To conclude, the key words here are: Do not EVER lie. It is fine and doesn't mean all hope is lost. Don't wear different colored pants and jackets. Solid white is always a safe option. You are not trying to make a fashion statement so you should be conservative. Silk makes a nicer knot and dimple than most other fabrics.

If you just can't, at least make sure it's well-groomed. Golden Rolex if you do have one. Long-sleeve blouses are best. Don't wear a hairstyle that covers your face. In general, keep jewellery simple, small and discreet. As soon as you can, after at least one to two years of work experience. A Masters degree can teach you a lot about finance. All MBAs are not equal. These are the best "target" schools to attend: We often hear this question about brainteasers: This is in fact the main purpose of a brainteaser.

Brainteasers can tell the difference. With brainteasers, the best way is to tackle them step-by-step, with a clear logic in mind. So how to handle brainteasers? Don't try to answer within five seconds. The trick here is to think that the numbers from 1 to can come in pairs that add up to Think about how many pairs there are. Remember that the hour arm will also move as the minutes pass. The clock is a degree circle. You've got a pool of water. How many times in a day are the hands of a clock at right angles?

How many numbers between 1 and 1, contain the digit 5 at least once Answer: A car drives from point X to point Y, a distance of 60 miles, at an average speed of 30 mph.

You have 5 pots of coins. One of the pots contains only fake coins. The fake coins weigh 9 grams. The difference between the total weight and will be the answer, e. Boutique investment banks are usually smaller investment banks that specializes in certain types of sectors or companies.

They tend to work on smaller deals or niche deals, usually below a billion dollars. Often, they will work on the the sell-side of a deal i. They are good places to consider if you didn't get an offer at the bulge brackets as they are not sensitive to poorer academic records except for the most prestigious ones and will be a first good step into investment banking. This independent capital markets adviser provides corporate finance advice, asset management, and deal execution.

Large accounting firm providing management consulting and transactionservices. Aperios Partners is a financial services group with activities in Investment Management and Investment Advisory. The company caters to corporations, venture capitalists, institutional investors, and private clients through asset management, corporate finance, sales, and trading. Investment bank focused exclusively on healthcare.

Expertise in IPO and Takeover Code transactions for prospective and current AIM and ISDX companies. Canaccord Genuity is a global, full-service investment bank focused on growth companies, with operations in 10 countries worldwide and the ability to list companies on 10 stock exchanges.

The firm offers mergers and acquisition, private placement, financial engineering, and business disposal and valuation advisory services. Additionally, it provides legal consulting services. The firm caters to information technology, telecommunications, and media sectors. Its clientele include Sushi Shop, Easyvoyage, Blue Consulting, Beezik, and Teleca group. Developing its presence in the UK. Gleacher Shacklock Specialist UK boutique of 30 people, based in London.

We provide direct counsel to corporate strategists and senior management. The firm provides mergers and acquisitions and sell-side advisory to technology-based sectors including SaaS and cloud services, mobility, IT services and outsourcing, internet commerce, infrastructure, information management, enterprise applications, and digital marketing.

Hampleton is headquartered in London, United Kingdom with an additional office in San Francisco. South aftrican bank with a focus on UK, South Africa and Australia. Strong in the US, has a London office. New River Corporate Finance LLP is an independent corporate finance business, advising on transactions in the UK and internationally. Our clients operate in four sectors: It provides merger and acquisition and corporate advisory services. Qatalyst Partners LP is based in San Francisco, California with an additional office in London, United Kingdom.

The firm offers mergers and acquisitions, fairness opinions, valuation, cross border transactions, bid defence, and buy and sell side advisory services.

Additionally, it provides environmental liabilities, carve outs, supply agreements, regulatory compliance, and intellectual property consulting services. In the majority of cases, it will include the following: The first task when you arrive will be to retake verbal reasoning and numerical reasoning tests. They are usually paper-based and can be slightly more difficult than the online version, or longer. The best way to practice is by going on to the SHL website and trying the sample exams.

My advice is to try all the easy questions first, and come back to the hardest ones later. You may also be asked to create a SWOT analysis. This will be similar to the first assignment, except that this topic will not be finance-related. Those usually come at the end of the process, right after lunch or on the following day. Wear business formal suits at all times. Dress to impress, while remaining conservative. From what we've experienced, here are our observations: London-based banks cover the entire European continent, and often, they also cover Middle East.

Additionally, speaking various languages means that you will be a more "transferable" resource. While speaking European languages is an edge, but isn't the critical decision factor. It could be better grades, more extra-curricular activities, or speaking more languages. Remember that "cultural awareness" is as important as the practical use of languages.

Banks are very global and multicultural organisations. But should you really care about other firms? This seems like a straightforward question; however, a lot of people handle this very badly. Always reply in a very positive and polite way, such as: Thanks again for the opportunity. You have to make a judgment call - is it worth taking the risk?

Club memberships are great if you can demonstrate that you are "active". The point here is to show initiative and leadership potential.

It typically shows that you have good interpersonal skills and initiative. Anyone can start a small business with a good idea. Below is some key advice: At smaller firms i. So you still need to pay attention. What should be the structure of investment banking cover letters?

An explanation of your relevant skills for the job that make you a strong applicant. Separate recruiting strategy advice i. Please enquire at founder askivy. This can't but impress!

Here is a CV tip: Being a "well-rounded" person is a recurring recruiting theme among investment banks. This is often called "the airport test": They show the bank your potential leadership skills, creative skills and open-mindedness. This section at the bottom of your CV is not there to look nice or to fill some space.

For each aspect, it will need to either show: Do not list a range of common, boring hobbies. Do mention linguistic ability following these categories: Watching movies is generally not a good hobby to mention everybody does it. When writing your CV, do ask yourself: Many use the money to live the high life: It's a bit like going to the Army. Those long hours spent checking models and presentations and making everything perfect to the tenth decimal point will transform you into a highly efficient analytical machine.

Apart from management consulting jobs, no other job can give you the same level of exposure to corporate strategy at such a junior level. You'll be working with CEOs and CFOs on corporate restructuring, strategic acquisitions, and IPOs; the learning curve will be unparalleled.

But when you are working on three deals at the same time, it is 3 a. Learning to prioritise, break down tasks, and stay cool under any circumstances are some of the skills you will develop in little time.

Corporate strategy, private equity, hedge funds, startups, you name it. The job has its downsides, of course. The secret to avoid this is to maintain hobbies outside work, keep your ego in check, stay in touch with the real world as much as possible i.

After being ceded by China to the British inthe colony of Hong Kong rapidly became a regional hub for trade with China and South Asia. Hong Kong initially started as a shipping and textile export center, but China's open-door policy in was the year that marked the new era of Hong Kong and its re-birth as a major economic and financial center. Manufacturing moved out to mainland China, was replaced by services, and Hong Kong GDP boomed as trade and investment links with China exploded.

Hong Kong has been handed back to China inbut it is still the. Hong Kong maintains a sound British-style legal system, has had a stock market since the largest in Asia after TokyoEnglish is spoken fluently, overall markets are well-managed, and the Chinese government is not too involved with its business yet.

Finding a an investment banking job in Hong Kong. If you want to get an investment banking job in Hong Kong, you should note that China's economic rise hasn't gone unnoticed by top students and investment bankers across the world. More Chinese students and investment bankers now want to go back home as opposed to staying in the U.

On top of that, competitive salary packages, low taxes max. London and New York. In other words, if you do not speak a local language Mandarin, Cantonese or do not have useful experience or local contacts, competition will be very intense.

In this case, hurdles are big and you will not be received with open arms given that:. Essentially, somebody else will have to do your work.

Because of this, you won't be taken seriously by clients or senior management. What can you do about it? Try to start in London and ask for a transfer later on, or network very very hard and start to learn an Asian language! Job hunting is much easier if you have local ties in China or Hong Kong, but you will still face intense competition. For London-based students and bankers, the best way to move to Hong Kong is often to start in London and ask for a transfer or look for a job at the associate level after two to three years.

A London experience will certainly give you a strong edge and earn you respect from colleagues and clients alike! In addition, analyst training is substantially better in Europe so you'll stand out compared to your peers, and analyst lifestyle is also much better in Europe so you'll avoid some suffering. Investment Banking Professional Experience in Hong Kong. Investment banking in Hong Kong will be an entirely different experience to that of London or anywhere in Europe and North Americaand is usually considered to be a less prestigious location for investment bankers.

The main reason is that Hong Kong and China are less sophisticated markets. Getting deals done relies more on "network" than strong execution skills or original ideas. This means that you will spend less time doing complex models and executions, and much more time writing prospectuses and travelling to talk to clients about latest market and industry trends. If you intend to stay in the region for the long-term or move on to another job locally, you don't need to be a modelling star anyway, and it is the network you are building over the years that counts.

If you intend to go back to Europe, you will still be able to catch up on those skills and having the "China experience" on the CV is an interesting differentiating factor. Finally, IPOs tend to be very profitable and this will be reflected in your year-end bonuses. Investment Banking Lifestyle in Hong Kong. Investment Bankers in Hong Kong work extremely hard and competition in the office is fierce, so prepare yourself for very long hours, especially as an analyst.

On top of this, you need to add frequent travels Hong Kong is a small island - your clients will mostly be in China and a good dose of "socialising" with your colleagues and clients after work.

Face time is also more common in Asia for cultural reasons, so working hours a week is commonplace, but it gets somewhat better as an associate. All will agree that Hong Kong is fun, and this is the key attraction for many. The food is great, the city is lively and exciting, China is just a subway ride away and it is a fantastic place for young singles to have fun.

There is a strong financial community and plenty of Western and Chinese-style entertainment which can rival the offerings in London and New York. If you like the green, quiet and open spaces of London, Hong Kong may not be the place for you. Your main cost in Hong Kong will be a decent accommodation, which can get very expensive.

The issue is space. In this regard, Hong Kong is much more expensive than London and New York. Nevertheless, many banks do subsidise housing to some extent. Other than that, food is especially cheap and other expenses commute, entertainment, travel, etc. Investment Banking compensation in Hong Kong. While salaries and bonuses at the junior level are pretty much in line between the two cities on average, on an after-tax basis, Hong Kong bankers will earn much more due to the very low tax rate.

On top of that, because housing is so expensive, many banks do subsidise housing in the form of a housing allowance. For locals and native speakers, after a couple of years, there will be many opportunities to work in mainland China at some point or for mainland Chinese banks, which can prove to be incredibly lucrative.

Based on our experience, of course they do. It is a fact that most bankers' friends are themselves bankers. Your friends will often consist of other junior bankers in other teams i. First, other bankers will be the only ones who can understand your hardworking lifestyle working very long hours, weekend work, emergency calls to the office and the only ones who can share with you "war stories" and rough experiences.

If you start to talk about the pitchbook you had to re-print at 5 a. Since this job can be hard emotionally at times, you will need to share your experiences with people who understand you. Second, they will be the only available ones. The social life of investment bankers consists of weekday dinners at the office, minute coffee chats, weekend dinners that are always organised at the last minute because you can never plan in advance.

If you cancel a dinner at the last minute, your banker friend will understand. If you have to rush back to your desk while having coffee, they will also understand. The harsh reality is that you will only be able to organise events at the last minute.

But this is not as bad as it sounds. Making friends with other bankers is part of the experience, and this strong network will help you tremendously in your career going forward. You will also make some of your best friends during banking training and while on the job, because you will be able to share tough times together, and good times together i.

The question is, are your non-banking friends nice enough to accept not seeing you several months in a row? You can have a social life, but it will be well-organised and planned at the last minute. Bankers do have social lives, take holidays, go to museums, go to nice restaurants, etc. The main difference is that you will not be able to plan ahead very often, and you will not be able to take part in regular activities such as yoga classes, tennis classes, etc. Dinners will be planned a few hours beforehand.

Trips and holidays will be booked a week in advance at best, if you are lucky except for Christmas and August holidays, which are typically very predictable. Be ready to be very flexible! In general, the higher-profile the bank, the less time you will have for social activities. Working at a Goldman Sachs or a Morgan Stanley means good experience and very good pay, but very little time to yourself.

If you work for a BNP Paribas or a Commerzbank, you will have much more free time and much less weekend work, but you will probably not work on many deals and be paid sometimes substantially below the market rate. Also, some banks have a better reputation than others in terms of work-life balance, and some teams within banks also have different lifestyles. Usually, this is mostly driven by the team size, the deal flow success of the teamand the style of your team head.

Generally, people are more respectful of your personal life, and periods such as Christmas and the month of August are very quiet. Therefore, compared to your Hong Kong or New York-based counterparts, you will be very lucky. They only get two weeks of holidays, and most of them are not able to take all of those days.

In general, they also work much harder for much longer working hours. This is not related to the business itself, it is more related to the local culture.

As a junior analyst, you will be slower with more things to learn. Also, because you are the most junior, you will be assigned the most tedious and time-consuming tasks. When you become more senior, you will be much faster, and you will "know the ropes", and will be able to manage your time much better.

As an associate, work become easier generally as you will have analysts to support you with your work, and you will typically start to leave earlier though still not at 7 p.

By the time you get to VP, things start to really slow down getting closer to that 7 p. Finally, by the time you make it stock market crash oct 7 2016 Director oracle stock trading Managing Director, going home by 6 or 7 p.

The pressure for them is not on completing tasks anymore, it is on generating deals and bringing in new clients. One of the key question students and future bankers ask themselves is "how bad are the hours in investment banking"? It is quite often difficult to get a real answer to this question. And if you want to ask HR or recruiters at banking true ecn forex broker, well And the truth is that is really depends.

Here is the unbiased answer from AskIvy. Its difficult to generalise as it depends on various situations further explained belowbut in Europe expect a minimum of 70 hours per week during slow times and up to hours per week at busy times. Investment bankers usually start quite late because they finish lateat around 9.

A quiet day means going back home at 9pm or 10pm, a more standard day would be finishing at anything between 10pm to midnight, and a busy day can stretch until the following morning. At peak times, it is not uncommon for analysts to finish past 4pm for several days or weeks in a row.

Weekend work is very frequent - this can be a few hours of catchup work on saturday or sunday, or at busy times working the all peacock trading livestock cta on saturday and sunday.

But the most important point here is that working hours are totally unpredictable. But you can also get suddenly dragged into multiple important transactions on a friday night and not see the light of the day for months.

Also, most of the day is usually relatively quiet between 10am to pmbut it often gets busy in the evening. No surprise there, because big banks will have more deal flow, and that means more work. But it's also a culture thing - people in the US work much more than in Europe, so banks with a strong US culture will make you work much more.

It is related to the working style of the team head some bankers can be more easy going, especially UK and some European bankersand also of the deal flow of the specific team. If the team is very successful, that will mean very long hours but if you end up in a team that only closes one or two deals per year, you'll have a more relaxed lifestyle. That is simply because clients are not active, which means less meetings.

It does get a bit better with time. When you are a fresh graduate, you will spend a lot of time learning the the best broker binary options to trade 60 seconds, so you will stay late. Also, you won't have anybody below you except interns to share the workload.

Most importantly, fresh recruits are not familiar with the politics in the office i. Unfortunately, it does get better but not that much - you will still work long hours throughout your analysts years. When you become an associate, the workload is slightly less, but you have a higher responsability so what you loose in working hours you gain in stress!!

The best example is building financial models. It is not possible to have many people working on an excel model at the same time. So when you are working on urgent deals, you need to work throughout the night to finish the model as fast as possible, and only when you are done can somebody review and check it.

Simply put - most of the investment banking tasks just can't be split. Because bankers are expensive, you simply cannot have an army of bankers on standby "in case" to meet peak time requests. Overall, it is cheaper to stretch resources and pay them a lot of compensate for the "stretching" rather than hiring more bankers that would be idle most of the time.

London and New York have long been and still remain the financial capital cities of the world. For many Europeans and others outside the US, New York always sounds like an attractive destination to learn Investment Banking from the best and have a "US experience" on your CV.

For Americans and many from Asia Pacific too, London is also attractive given the more comfortable lifestyle it offers, and opportunities to work on deals across woodstock blu ray best buy European countries.

Based on our experience of working in the US and in Europe, here are our thoughts on Investment Banking in New York vs. Investment Banking in London. New Yorkers often imagine their city at the centre of the world.

Look at a map. America is on the left, Asia on the right, and in the middle is Europe. More precisely, London is in the centre. London has always depended on trade and immigration, which have been the key drivers of the city's status as a financial centre. Even as far back as in the nineteenth century, the City has always been dominated by foreigners in the business of banking and trade.

But after war engulfed Europe inEurope had to recover and the City lost its place in global finance to New York. As the US was untouched by the war and the started to industrialise rapidly, it quickly filled the gap left by London and took the lead in financial innovation. But London eventually caught back in the last decade as the influx of so many sophisticated French, Italian, Spanish, German, Chinese and Indian immigrants started to dramatically improve the quality of London's workforce.

While after September 11 businesses suddenly had to struggle to get visas for employees to work in New York, or even to visit on business trip, visas for Britain have always remained easily available.

Also, with the numerous scandals and high-profile bankruptcies in the US Enron, WorldCom, Lehman Brothers, Bear Stearns - all US firmsinvestors started to think that the US environment might not be the best, after all. Overall, investment banking jobs are easier to find and to keep for international students in London than compared to the US.

The main reason is due to visa issues: The immigration process in the US is lengthy, complicated, and very expensive. Therefore, most investment banks in the US will not bother to look at CVs of international applicants: In comparison, the immigration process in the UK is much simpler, cheaper and more transparent: The other reason is that languages and multicultural experiences are ghana stock exchange composite index 2016 as valuable as they are in the US than in the UK.

The US is a very large country, and therefore investment banks will mostly do domestic business as well as South American businessand will not require bankers to speak many languages. In Europe, speaking various languages, especially Europeans but also to some extend Asian languages, is highly valued.

On your CV, a stint in New York will always look very good and tend to impress people more than a similar stint in London. This is how to make money on internet ehow because New York has had an established reputation as the leading financial centre for the last 70 years, the fact that the US still is synonym with the "American dream" for most people, and also because working in the US tends to be so much more intense.

Americans work extremely hard and long hours - there is often no london stock exchange rns search between private life and professional life, especially in New York. Therefore, you are more likely to close more deals and work on more transactions in the US compared to the UK.

Also, the domestic market is very active: Therefore, from a general perspective, Americans tend to be better at what is earnest money receipt agreement modelling due to their more extensive experience, and they are used to handle a lot of stress compared to their European counterparts. A significant downside of working in NY however is that working in New York will not give you a "global" perspective of the investment banking business.

You will only know about the US financial system and regulations, and you will only know about the "American way", which will be extremely different from what is done internationally. Working in London, the majority of your deals will be cross border or outside the UK, you may work capm indian stock market tips free on mobile IPOs in Russia, deals in Middle East, mergers with Chinese companies, etc.

Finally, another downside of working in the US is that future career options in the US will be limited as a foreigner, because things in NY are so US-centric. US companies tend to hire local staff, and being an outsider it will be much more difficult to have the necessary professional network and cultural connection required to climb the hierarchy fast or change jobs.

But if you intend move back to your country in the medium term, this is not a problem. New York is more fun than London for the young, party-going types because of the club and bar scene. However, New York is a big block of concrete, extra cold in winter, extra hot in summer, and if you are a nature-lover or a family-type person you will be very disappointed and it can be very exhausting.

Native New Yorkers are not the most friendly bunch either, and can be very rough. The London party-scene is also good but London is more quiet overall, with lots green spaces, and much more family friendly. London is also unique in that you can travel all over Europe very cheaply for weekend breaks. So if you plan to party a lot, go to NY, and if you want a more "settled" lifestyle, go to London.

Both will be small, overpriced and likely quite old. Other cost are also about the same, except from transportation which is more expensive in London but you'll use taxis to go back and forth to the office anyway. Salaries and bonuses at the junior level are pretty much in line between the two cities and this will remain the case so as not to have a massive exodus to one of the two cities.

If you take into account currency exchange rates, then it all depends on your home country and what you plan to do with the money. Life as an investment banker will be a dramatic change from your student days and your usual lifestyle. No more free time to play sports with your friends, eat healthy home-made food and get 8 hours of sleep.

As a banker, unless you are good at avoiding work, you'll sit 16 hours a day in front of your computer, and the only exercise you will get will be performing super-fast excel shortcuts, going to the printing room to get pitchbooks, and fetching calories lattes at Starbucks. Combined with the lack of sleep a direct cause of weight gain and the fact that with your big dinner allowance you feel compelled to eat as much junk food as you can for dinner, weight gain is inevitable.

Most banks have in-house gyms or have discounts for gym memberships. As a banker, you may not have the time to go to the gym: But in fact, the best times to go to the gym are before lunch or before dinner.

First let your collegues know that you'd like to go to the gym at a certain time, and they'll know where to get you. Second, because its at times when people are usually out, it makes it easier for you to sneak out for some exercise.

Bankers like squash — it makes them feel cool. Ask the members of the team if they play squash. Often, MDs and VPs will play, and this may be the perfect opportunity to socialise and get to know your colleagues better just try not to hurt them by playing every Thursday night, which will become handy at appraisal time.

Always eat breakfast, and don't stuff yourself at dinner time. Best is to order some light food such as fish, sushis, salad and some soup. Use the extra allowance to buy some fruits, nuts, yogurt and snacks to eat during the next day.

This will help you how to get fv cash cheat burning out during the day, and definition of great stock market crash you less dependend on caffeine to stay alert. If your friends always go to Starbucks, go with them but you dont need to order anything, or just get some tea.

Cappucinos, lattes and mochas are very fattening and unhealthy. Also be careful of evening drinks as beer is very fattening, try not to go for drinks more than one or twice a week, and, as a general rule, it is always better to forex account with high rollover rate alcohol there is no shame ordering orange juice or a diet coke!

Do not be fooled by titles - there is not much difference between analysts and associates. MBA associates are usually disliked by investment banking analysts. In reality, beyond title and pay, there is not much difference between the work done by an analyst and an associate. Even if you are much more experienced, older, and have graduated from a top business school, you still need to do your fair share of grunt work - see tip 2.

Analysts know better than MBA associates; they are better technically and they know how to work the system. They truly resent wasting their time explaining everything to MBAs. So analysts need to be your allies; buy them lunches, get to know them, learn from them, and praise them in front of senior bankers when they do a good job. This is a good investment; your analyst friends will probably save your life by fixing your models and helping you navigate office politics.

Sure, a top MBA is impressive. This is partly why you got the job in the first place. However, now that you have joined the ranks of investment banking, your degrees are irrelevant.

The only thing that will get you paid in investment banking is hard work, a great attitude, and strong social skills. Get up the learning curve ASAP - MBA associates are the first ones to get fired in 2 minute binary options platform dan anderson downturn.

Banks cut staff every year, and remember that you are at a significant disadvantage compared to those who have come up through the analyst ranks. If Banking is a stepping-stone to something else, start planning your exit on Day One. If your goal forex dynamic support resistance to stay in banking for a couple of years and then move to the buy-side, back to the industry or anything else, plan early.

Having an objective also makes the lifestyle more bearable. Use your MBA to build a support network internally. Ask your alumni for advice capm indian stock market tips free on mobile introductions to other people.

A support network is particularly key at bonus stock options tax deduction or redundancy time.

MBA associates tend to have a tough first two years. However, they tend to perform very well once they make it to Vice-President level and above, when soft skills become much more important than technical skills, and when the focus is on building relationships with clients and managing people.

As much as we may dislike it, investment banking is a very political world. A mentor is another person in your workplace, typically much more senior than you i.

A mentor will be an immensely stock trading success dvd asset for your career. Also, you can ask your mentor questions you would never dare to ask to others: Pick somebody you can learn from! Once a high-profile CEO told me: Pick somebody you admire. This means they should be successful in their field: Pick "nice" people that you feel would be willing to spend some time talking to you.

Are they friendly, funny, and nice to assistants? Try to find somebody else. Do not to be over-aggressive. Also, explain why you would like to meet them. Be very clear and honest in what you want to do.

It is important to maintain a professional attitude with your mentor. There are plenty of exit opportunities at the analyst level! This is because analysts are young, well- trained, ambitious, work very hard and can handle stress. Essentially PE funds and Hedge Funds are using the banks to train their juniors. Exits for Vice Presidents are not many. For the reasons mentioned above, this is the most common exit. This is not a common exit although it does happen.

This is the most traditional exit opportunity for a Managing Director. Summer is usually a more relaxed period with less deal activity, however, there is always something that needs to be done.

If you don't get assigned much work and find yourself idle, don't just browse the Internet and wait. Be proactive in approaching your team to ask if there is anything that they want you to get done. Rather than asking "can I help with anything", try to suggest something to the analyst or associate such as "I have seen you with this precedent transaction database in folder XYZ, do you need any help in keeping it up-to-date? Always check, re-check, and re-recheck your work again before submitting it to anybody.

Reliability is one of the most important qualities of an analyst. Do not be seen as someone who produces sloppy work with typos and other mistakes. If you are in doubt, always ask an analyst to check things for you.

Always come to all meetings fully prepared; that means, bring a notepad, a pen, and a calculator and always take notes. As an intern, you may be assigned very tedious, repetitive, boring tasks. Remember that you have to prove yourself and go through this type of work before being trusted enough so that you can do some more interesting things.

Go through it with a smile, and always be eager to take on more work, any kind of work. This will pay off in the end. Needless to say, never complain to anybody about the type of work you are select options with jquery, even to other interns. You never know who is listening. Come in early never after 9 a. If you are frequently going home before 9 p.

Ask your teammates for coffees if you see that they have time. Go for lunch with them. Say hello to them when exchange rates rupee to gbp arrive in general motors stock buyback morning, and say goodbye when you leave in theory, you should be saying goodbye when they leave before you!

Make an effort to engage in small chats from time to time, but do not pester them. If they ask you to go for drinks, go to the pub, and have lunch or dinner or anything else with them. Just be smart and sensible about it. Also read our article on networking during your internship. Try to identify the person in the team who is most receptive to you. Some people may just not enjoy talking to interns, or they may just be too busy. Try to identify the most friendly who will answer your questions patiently, and ask them for advice.

In the end, they may be the one who will fight on your behalf to give you a full-time offer. This means that you should not complain, even if the job is very intense and very demanding. This also means that you should have a positive how to make moneybags thai in difficult situations and have a "let's solve this problem" attitude.

It also involves being proactive and always being friendly with all of your colleagues, secretaries, and admin staff, below and above in the hierarchy. This is obvious; investment banking is a tough job and hard work will be required. Most analysts tend to finish very late, and therefore come late to work. Being late means arriving at the office anytime after 9: It may be the case that many analysts or your colleagues arrive at 9: This will always be noticed by your seniors and is not a good sign.

Ideally, you should be at your desk at 9 a. Try to follow the unwritten rule of the team: Accuracy is a key skill that analysts and associates need to develop. Take a habit to triple-check your work, and cross-check every number from several different source. If you make many spelling mistakes, people will assume that you will also make mistakes in valuation models and more important tasks.

Never pass on work to your seniors without triple-checking everything. When you prepare a presentation, you will refer to the same numbers several times in different places. Make sure the presentations and models are consistent as a whole. Always reference all your sources for every fact and number in your valuation models and presentations. This is the most important job of an analyst and the associate. Pay attention to the small details. Presentations in PowerPoint and Excel need to be accurate, but they also need to look good, while remaining simple to modify and understand.

If you prepare clean work, people will be impressed and you will gain their trust. To be professional and get the chance to be invited at client meetings, always be ready. Also, have the important files printed and ready to show to seniors. If you don't know or understand something, you always need to ask. In your first year, people will accept that you have to learn and you may not know much. However, if you wait too long and people realise you don't know much earnest money contract sample you are trader joes vegetable stock ingredients your second or third year, this will create trouble.

However, be thoughtful when asking questions; identify the person that is the most open and friendliest to answer your questions, and do not ask questions in front of everybody. To survive your analyst and associate years, you will need to rely on your colleagues to give you a hand, explain you complicated concepts, check your models, send you templates, etc.

Therefore, networking is key to your deposit forex pake paypal in this industry.

It is fine to make mistakes from time to time. However, do not make the same mistakes twice. When you make a mistake, be sure to understand the reason fully and master the concept so that it forex sessions time table happen again.

During your time as an analyst or associate, you will receive a fair amount of blame and criticism. People will criticize your Excel models, your formatting style, your communication style, and everything else. This is part of the investment banking culture and you need to accept it and not take it personally. Take criticism as a chance to improve. If you feel frustrated, vent your anger and frustration with trusted friends, and never release your anger at the person criticising you, even if they are wrong.

In the end, you learn by making mistakes. Also, if you are criticised unfairly do not worry about it - most bankers are a smart bunch and can realise when somebody is being criticised unfairly, even if they keep quiet.

So let's plunge into the mysterious depths of the year-end appraisal process. At most investment banks, the process moves like this:. Sometimes they will show you the reviews, sometimes not. The review will be based on various criteria such as: In most banks, they will rank you as "performing above expectations", "performing as expected" or "performing below expectations" for each of those criteria with some commentary.

Best Mobile Trading Apps in India - 2017The size of the bonus pool depends on the performance of the bank as a whole, the revenues that have been generated by the team, and other "market forces", which include current salary trends, post-financial crisis, and the political environment.

The ranking is based on the scores in the review, but most of the time it is actually the team head making the call. You will be either ranked in the top tier meaning: Let's face it, analysts and associates don't generate any revenues, and the PowerPoint slide from analyst A is no different from PowerPoint slide from analyst B. What you did not do well will definitely come up at appraisal time. What can you do to be in the top tier then? Here are a few tips: When you first join a team, don't be a smart-ass and keep asking for the best deals, even if you are a superstar.

Otherwise, you'll be in the "annoying smart-ass" category, and that's a guaranteed bottom-bonus for you. First impressions count and last very long. Do surgical technicians make good money Golden Rule is: At the end of the year, a good attitude always pays off, because that's really the differentiating factor between you and your colleagues.

Bankers have short memories, so you'll be evaluated mostly on what they can remember, which is the previous two months at maximum. So two months before bonus time is the best time to put that prompt binary options with a minimum deposit list effort and to triple-check those models before you show them to anybody at a senior level.

Get your fellow analysts and friends to help you check things and put in the extra care; it will pay off. Don't be seen as just a pure modelling geek. Talk to people in your team and outside your team.

Investment Trusts | interactive investor

Get introductions from your friends and get to know your alumni, take coffees with them when you can, so that you can get a good feel of what is happening in the office and make good first impressions see advice 1. The more people you know, and the more people have a first good impression of you, the better.

Because people talk, and if your name is associated with something positive, that will directly impact your chances to be ranked at the top. Finally, don't be obsessed with a number! While you may not end up getting what you want, think about keeping a positive attitude. Being ranked at the top is great, but what you should really aim for is avoiding being ranked at the bottom.

Also, you may not get ranked on top this year, but there is always next year. Remember that investment banking is very much a career that required a lot of patience, and the really big rewards will really start to come at VP level and above. Here is our view: The main difference between back office and front office is quite simple.

Front-office jobs will typically be more challenging, be more high-pressure, less stable, involve longer hours, but they will often pay much more. What are my chances of moving from the back office to the front office? Moving from back office to front office is quite difficult in investment banking, but your chances will depend on a number of factors, including:.

After more than two to three years in a back-office role, it becomes significantly harder to move because your skills become less and less relevant to front-office roles. It is easier to move if you have directly relevant qualifications ACCA, CPA, CFA, etc. This means that you need to show you are able to "network" your way into and outside the organisation. The more you are able to network with your peers and front office people and potential clients, the better.

It will be much easier to move if you are a top performer within your team and have a good track record and reputation. This will also help your case with the HR department. Your how to get fv cash cheat will depend on the company's policy and culture.

Did anybody around earn money ukraine move from back office to front office? Has the HR department best retirement annuity funds south africa management said that it could be a potential career development path?

How long does it take to get unemployment money in pa, the company's prestige doesn't really help - for example, working in a back office role at Goldman Sachs will not mean that you are better placed that a back office worker at a smaller institution to make a move to the front office.

It is much easier to move from the back office to other departments in bull markets, because that is simply when people are needed, when the companies have larger hiring budgets, and when hiring practices are more flexible. Strategies to move from back office to front office.

Moving across organisations from a back office role into a front office role is almost impossible, unless you are a fresh graduate one-year experience with a good academic record.

The best way to move to the front office is simply to network as much as possible, as early as possible, within your current organisation to find out about potential opportunities and educate yourself on what is required to seize those opportunities. However, one needs to be careful in voicing the desire to move to the front office, as this could the stock market bar melbourne upset your manager and put you in danger — the best way to network is to have "informative" chats discreetly and build some personal relationships with front-office people.

At the same time, if your educational background is not top-tier, acquiring qualifications such as the CFA or the ACCA can be extremely useful to demonstrate your motivation. Finally - do not give up even if you get negative feedback.

Many headhunters, colleagues or front office people will tell you that the move is impossible. A move is always possible - it just depends on how much effort you are willing to put crash in indian stock market of 1929 facts getting the job.

If you have remained too many years in a back office role, or if you find that your zero plus stock market efforts are not bearing fruit, going to business school is a good way to transition into front office roles.

This is no magic degree however — only degrees from the top 10 to 15 global schools will unlock investment banking front office jobs, so it will not be worth spending large amounts of money and valuable time on obscure schools. Master Degrees in Finance can also help - but again, those will need to be obtained at top tier schools with instantly and globally recognisable brands.

The CFA Chartered Financial Analyst designation is a professional certification granted by the CFA Institute, which tests and focuses on portfolio management, financial analysis, and generalist aspects of some other areas of finance. To become accredited, the candidate needs to:.

Pass three six hours exams which are called "levels": Note that you can still study and pass the exams even if you have no how do prepaid card issuers make money, but you will only receive your accreditation after you meet the work experience criteria.

There are aboutCFA certified people in the world. Most people taking the CFA are finance and investment professionals, particularly in the fields of investment management and financial analysis of stocks, bonds and their derivative assets.

There are common misconceptions that students and junior finance professionals have when they decide to study for the CFA. The most common misconceptions and wrong reasons for studying the CFA for investment banking are:. Do not think of the CFA as a magic qualification that will turn your CV around.

The CFA how to make spicy roasted cashews not cover for poor academic performance or for having graduated from a less-known university. On the opposite scenario, if you already graduated from a top school, adding the CFA qualification will probably not make a significant difference to potential employers.

Unfortunately, there are how to get big money onyx medal fast many people with CFAs nowadays that even though people will recognise that getting the CFA is a lot of hard work, the qualification has definitely lost some of its prestige.

In fact, only very few bankers have the CFA. A lot of the content of the CFA study is not directly relevant to what you will do as an analyst or associate in investment banking, except maybe for the parts about financial analysis, equity valuation and corporate finance. Nevertheless, those are just a subset of the content of the CFA programme, and you should have already mastered those concepts by the end of your training programme anyway.

Most importantly, the CFA doesn't teach you about how to model, how to put pitch books together and how to work hard with a great attitude, which are the most important skills for a junior investment banker Finally, studying for the CFA is a lot of hard work, and you'll work hard enough as a banker already - you might want to invest this time in something more productive such as networking with colleagues, bosses, potential employersworking even harder, preparing an MBA or even getting some rest!

The CFA is more relevant to and most valued by the investment management industry, as getting the qualification indicates a good understanding of investment management theoretical concepts, as well as a strong degree of interest and commitment to this industry. In some firms, and in many equity research jobs, it may even be a requirement.

It is not a requirement for private equity firms however. A downturn if you still have a job is the best time to take advantage of company sponsorship programmes for accounting and CFA qualifications! What kind of work will you do as an investment banking intern? As a summer intern, this will probably take up most of your time.

This may sound relatively straightforward, but is often very time- consuming and can be relatively complex. Investment Bankers like to show profiles of potential acquisition targets to their clients. Comps are boring, time- consuming and very tedious to compile, so nobody likes to do them. Another boring and tedious task assigned to interns. The result could be quite interesting, but the process is very tedious and time- consuming. Interns typically don't do much modelling.

Below are a couple of useful tips on how to handle the situation: All of these excuses will make you lose credibility. Some other valid reasons to justify being fired can be: On a side note: You can be fired for a whole lot of reasons, but sometimes, you will just be unlucky.

Leave the firm on a good note, and don't forget to network at all time! The way to differentiate yourself is through your own connections. Don't be afraid to reach out to them to enquire about any openings in their new teams.

Securing a good investment banking internship is not an easy task. To maximise your chances and get ahead of the masses, you'll have to learn how to network effectively. Networking is really just a fancy word for meeting and talking to people, but building strong networking skills will be of tremendous help throughout your career. Why does networking pay off? Also, there may not be a spot for you in the specific team you interned with, but there might be a spot in this other team you happened to talk to!

You never know who is going to end up where, and how you will bump into them, their friends, ex-colleagues, or need their help or advice some day. This is stating the obvious, but most people tend to stick with their immediate colleagues and do not dare introduce themselves to people they don't know. Especially if you are new or show interest in people's work, they tend to be receptive and willing to help and discuss.

In the worst case, they will just ignore you or say that they don't have time. Your boss won't view you talking to other teams as something negative, after all, you are there to learn! You just have to force yourself to do it.

A few tips to make things easier: You can ask junior colleagues in your team for an introduction to people in other teams or departments i. You can ask other interns in other teams to ask you to join them for coffee next time they go with the people in their team.

You can approach recent alumni, friends of friends, people from your own country if you are from overseas, etc. But don't overdo it, otherwise they'll view you as an annoying pest.

Try to be more casual and personable sometimes. Sport is a safe topic, and there is plenty to say over the summer with football and tennis. If you are passionate or curious about a specific area, share this with people around you. Most professionals will realise that your goals are not set in stone yet, and that you are still trying to find your way. For example, if you say that you are interested in working for a private equity firm in the future, they will be able to tell you the best team for joining in the bank i.

Stay in touch with people — having coffee or saying hello when you walk across their desk goes a long way toward making people remember you. When your internship is over, send an email with your contact detail to each person you've met. Ideally, you should try to meet each of them and say goodbye in person. This will leave a nice last impression. A few other tips: If you haven't done so yet, create a LinkedIn account and invite those people in your network so you'll be able to track them if they move to another bank.

Managing Directors are Directors who have been promoted to the next level as well. Director-level bankers' role is very much client-facing, and they now take direct responsibility for profit generation and also for setting the strategies that can help maximise those profits. However, this is not a relaxing lifestyle. Because they rely so much on analysts, they will spend a lot of time training them and showing them how things are done.

Associates will receive requests directly from a wide range of people: VPs, Directors, and MDs. Their job will be to divide the work and allocate the tasks between themselves and analysts, and chase up various people to make sure that everything is produced accurately and on time.

Associates spend a significant amount of time on the phone and sending emails around, getting things done. Associates also do a lot of analyst work, creating slides and producing financial analysis. But they usually handle the more complex financial modelling and difficult tasks.

This is especially the case in live transactions, where their work will be reviewed by the VPs. Associates will deal directly with internal legal and compliance teams in live transactions, liaise with other banks, accountants, lawyers, co-advisers, etc.

They will create agenda topics ahead of meetings, and participate in analyst recruiting. Associates work at all levels, and occupy a critical in-between position. They deal with analysts to whom they give work, and get requests from VPs, Directors, and MDs. They often interact with other teams in the bank and have some meaningful client interaction. Yes, but not as long as analysts. A good day starts at 9: Expect 70 to 80 hours per week as a guide.

However, this is not an easy lifestyle at all - Associates are under tremendous pressure as they have to manage analysts i.

Also if anything goes wrong on a deal or for a presentation, the Associate is always the person who will be held responsible.

Associates are promoted to the VP level after three to three-and-a-half years. Becoming a Vice President is a competitive process and promotion is not automatic; in many cases, third-year Associates can be asked to leave the firm. Associates will have to demonstrate that they can manage transactions, that they have fully mastered the technical aspects of the job, and they need to be well appreciated by people in their team and other teams.

The Vice President will divide the work that needs to be done, and allocate it to associates and analysts. Vice President will be the main contact points with the clients, the potential targets, the accountants, lawyers and any other party working on the transaction including the financial regulators, internal compliance and legal teams, co-advisors, etc. Therefore, Vice Presidents are really running the show.

Vice Presidents also have to start trying to generate deals While analysts and associates will work on "processing" deals and not talk to clients much, Vice Presidents will be allocated a portfolio of clients that they will need to meet regularly and propose ideas to. They will either go to those meetings with Managing Directors for important clients so that they can watch and learn "marketing skills" from themor will go by themselves for less important clients that Managing Directors do not have time to follow.

Therefore, Vice Presidents spend most of their time on the phone, writing emails and at client meetings, either coordinating work on deals or proposing ideas to clients. They will do less and less "technical" work and typically are not much involved in financial modelling and the making of presentations, only providing high level reviews for important transactions. Vice Presidents will work with everybody in the organisation, from analyst level to Managing Director level, also work across the organisation i.

Working hours spent "in the office" are becoming much lighter at the Vice President level. They have a stronger degree of freedom because they are getting things done by others as opposed do doing things themselves. Most Vice Presidents tend to come in at 9 and leave the office between 7 to 9 pm. Nevertheless, despite the apparent lighter schedule, there is quite a bit of "hidden" workload because they need to take phone calls, meet clients and answers emails very frequently, which of course involves frequent blackberry checking on late evenings, weekends and holidays.

Vice Presidents are typically promoted to director level after three years sometimes this level is also called "Senior vice-president". Finding and organising data, in Excel or PowerPoint, from the Internet and the multiple databases that the bank has access to. This can be finding the number of mobile phone subscribers in Lithuania, finding the shareholders of a specific company, or finding out names of the top five companies selling oil pipes in Europe.

Preparing a PowerPoint presentation usually one or two slides about a specific company, including business and product description, market shares, latest financials, share price performance, key management bios, calculation of trading multiples, etc. It is not uncommon to be asked to do this for twenty companies, or even more.

A 'Pitchbook' is a fancy word for PowerPoint presentations that are shown to clients to try to obtain their business. As an analyst, you will be asked to create slides that will include various financial analysis, profiles, a presentation about the bank, and recommendations to the client. This involves updating share prices, updating new financials when they are released, calculating net debt, and doing a number of accounting adjustments. Taking notes at meetings, organising conference calls, preparing internal documents, literally running around to print and carry the books before presentations, printing and checking documents for associates, VPs, Directors, or Managing Directors.

You may end up working with more senior people, but this will be more of the exception than the rule. Depending on your relationship with your assigned Associate, they can be your best friends or worst enemies.

Some associates will dump a lot of work on you you will quickly find out that every person who is your superior has the right to dump work on youbut almost all of them will teach you how to do a good job as an analyst and will be very valuable resources. They are usually tough, but don't forget that while Associates may dump a lot of work on you, they have tremendous pressure from VPs, Directors, and Managing Directors.

You will also spend most of your weekends in the office not all of them,you will get a break from time to timealthough weekend work is much lighter and you will only be in for 4 to 5 hours.

Overall, expect to work a minimum of 70 and up to to hours per week. The better the investment bank from league table perspective the worse the hours, because they will be extremely busy. You can maintain a social lifebut spare time will be scarce and you will have to learn how to manage your time efficiently.

What usually happens is that other analysts will become your best friends and you will support each other through the difficult times. The standard is after three years, at which point you become an Associate. These books vary in difficulty, so we rated them: John Rolfe, Peter Troob: A very entertaining story about two fresh graduates of Wharton and Harvard who start their investment career at the hottest investment bank at the time, DLJ bought by Credit Suisse later on. Overall, it is a gross exaggeration of the life of an investment banker and very very NY-centric, can be vulgar at timesbut it will give you a very good idea of how tough the job of an investment banker can be; it is will worth reading.

Most investment bankers will have read this book, and it is a fun read before you embark on your investment banking career, highly recommended!