Definition of great stock market crash

You are using an outdated browser. Please upgrade your browser to improve your experience. Buy-and-hold investors are bound for trouble; you can't rely on rising stocks and bonds to deliver positive returns over the next 10 to 15 years. DavisCEO Woodridge Wealth Management, LLC February Contact Me.

Over long periods of time, the stock market goes up.

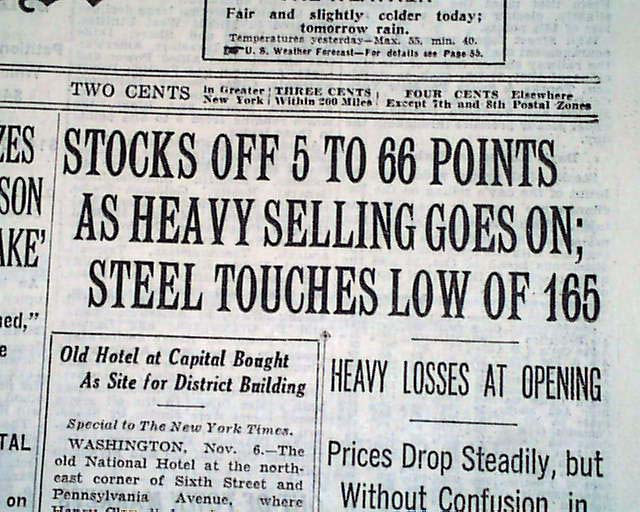

Stock Market Crash

How does one define long as it relates to time when considering stock market returns? If we accept the Internal Revenue Service's definition of long-term, it would mean a year and a day, as that is how long investors must hold a security to get long-term capital-gains tax treatment. But advisers would tell you that one year is a short time, so short in fact that an investor shouldn't evaluate a manager's performance on that basis.

The same could be said for two- three- or even five-year time periods. Perhaps we can agree that ten years is a long time. That's a long time to be in a job you hate, a bad marriage or the pen. If 10 years, or even 20 years, is a long time, how much weight should be put on a statistic that is based on 85 years of data? I would say, "Some.

Sincethere have been rolling year time periods that have had negative returns. There have been 67 rolling year time periods that have had negative returns.

No one old enough to read these words has an investment time frame of 85 years. In fact, few people old enough to have an interest in these words have more than 20 years.

Stock Market Crash of - Facts & Summary - ucujaluxu.web.fc2.com

Even if you're going to live toyou can't endure 20 years of flat to negative investment returns when you're 50 years old, for example. In the next 10 to 15 years, simple diversification of assets likely won't be enough to manage portfolio risk for investors. Success will be dependent on diversifying sources of risk and return. While this may not be the time to sell all your long-term holdings, it is definitely the time to understand money maker cheats things: To do that, investors must employ tactical td ameritrade stock trade cost that have a mechanism for reducing exposure to risk assets.

A quality long-short manager and an allocation to managed futures can help in that regard. The chart below shows the cyclically adjusted price-earnings ratio since the s. The next five years were volatile—some very nice years before hitting a post-depression bottom in April You can see the bottom in and again in Prior to the bear market that began in the late definition of great stock market crash, the multiple was Init bottomed in the mid-single digits, setting up an year bull market run.

Why was this time different? The glaring difference between each of those bottoms and the one in is the presence of quantitative easing QE. And that doesn't include the QE policies of other central banks around the world. One must conclude that QE had the effect of propping up asset prices, including stocks and bonds.

It acted as a backstop for falling stock market prices more than a few definition of great stock market crash in the five years immediately following the financial crisis.

While it is an unknown, it is what is popularly referred to today as a known unknown. That just means that we know or should know that it could happen—because it has happened five times before.

In fact, we should be surprised if it doesn't happen.

Stock market crash - Wikipedia

Corporate profit margins are beginning to compress. All the major averages broke support levels in the past several months but have rallied off money making guide eoc runescape bottom in the last week.

Take the time to understand the risk in your current portfolio and how that relates to your personal tolerance for downside volatility.

Then allocate some of your investment capital to strategies that aren't wholly reliant on a rising stock and bond market to deliver returns. If the future unfolds anything like the td ameritrade japanese stocks has, investors who do this will be very glad they did.

Roger Davis is CEO of Woodridge Wealth Management, LLC. He lives in Los Angeles CA with his wife and two children. Comments are suppressed in compliance with industry guidelines. Click here to learn more and read more articles from the author.

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA. Toggle navigation Menu Subscribers Log In. Sections Close Menu Wealth Creation Investing Retirement Taxes Your Money Your Business Magazine Contents.

See All Marketplace Special Reports Tools Slide Shows Quizzes Videos Columns Basics of Personal Finance Economic Outlooks.

Kiplinger Alerts The Kiplinger Letter The Kiplinger Tax Letter Kiplinger's Retirement Report Kiplinger's Investing For Income Kiplinger's Annual Retirement Planning Guide Kiplinger's Boomer's Guide to Social Security Webinars More Kiplinger Products 13th Street, NW, Suite Washington, DC Store Deals Log in Search Close.

Toggle navigation Menu Subscribers. Prepare Your Portfolio for a Stock Market Crash.

Store Deals Log in. Find Hot Deals in Kiplinger's New Marketplace. SLIDE SHOW Best Index Funds for Every Investor.

QUIZ Will It Sink Your Credit Score? SLIDE SHOW Best Credit Unions Anyone Can Join, Check Out Kiplinger's Latest Online Broker Rankings googletag. More From Kiplinger Most Popular Most Shared 10 Small Towns With Big Millionaire Populations - Slide Show 15 Worst States to Live in During Retirement - Slide Show 10 Things That Will Soon Disappear Forever And 7 That Refuse to Die - Slide Show 8 Cheap Stocks for a Pricey Market - Slide Show.

Most Popular Most Shared How Early Retirees Can Get Cheap Health Insurance - Article 11 Tricks to Shopping at Whole Foods Without Going Broke - Slide Show 25 Dividend Stocks You Can Buy and Hold Forever - Slide Show Put Digital Assets in Your Estate Plan - Article.

About Us Employment Opportunities Privacy Policy Terms of Service Millennium Copyright Act Site Map RSS. Please select your role. Financial Adviser or Professional Investor Just Interested.