How do prepaid card issuers make money

Prepaid cards are the hottest things going in plastic these days. They allow consumers to load money onto the card and make purchases or cash withdrawals. Unlike a debit card, prepaid cards aren't typically tied to a checking account, and they're largely intended for consumers who don't have a bank account and households that use alternative services like payday loans and check cashing services, says Brent Watters, senior analyst with the prepaid advisory service at Mercator Advisory Group, a banking research and consulting firm.

But the cards are also popular with college students or other Americans who may use them to help manage finances and avoid debt. Indeed, since the recession, the cards have increasingly been marketed to the average consumer as a tool that helps them avoid overspending, Watters says.

But experts say there's a huge downside to prepaid cards: Consumer advocates say the high costs wipe out most of the benefits of using prepaid cards. Card issuers charge all these fees to handle the costs of these cards, including data processing, customer service and fraud management, says Rob Rosenblatt, CEO of UniRush, a company founded by music mogul Russell Simmons that has a series of prepaid cards.

Here’s Why Employers & Banks Love Putting Wages On Prepaid Debit Cards, And Why Employees Keep Their Pay In Shoeboxes – Consumerist

But, he adds that "cards should be free," noting that the company plans to reduce its fees in the future. Personal finance guru and TV celebrity Suze Orman, comedian George Lopez, musician Lil' Wayne and Yankees third baseman Alex Rodriguez have at least one thing in common: Consumer advocates worry that the celebrity marketing could encourage people to sign up for cards that have a host of fees and limitations. Already, at least one celebrity prepaid card has crashed and burned: Less than a month after the reality TV stars the Kardashians launched their prepaid card in , they pulled it from the market amid a storm of criticism.

Card companies counter that the celebrity pitches are genuine and that the cards are good deals, in particular as an alternative to carrying cash for consumers who don't have bank accounts.

Separately, A-Rod partnered with Russell Simmons' RushCard prepaid cards back in September. Meanwhile, Suze Orman is funding her card, introduced in January, with her own money.

At least 41 states are now using prepaid cards to distribute unemployment benefits to their residents, according to the National Consumer Law Center. Just three of those states -- Alaska, Florida and West Virginia -- offer both paper checks and direct deposit as alternatives.

Using prepaid cards can save states money because they don't have to print checks or deal with the costs of checks that get lost in the mail or that don't get cashed, says Lauren Saunders, managing attorney at the NCLC. With prepaid cards, the banks, not the state governments, incur most of the costs if they're lost.

For the jobless, card fees can eat into the already meager unemployment payment they receive, says Saunders. Cardholders who want to speak with a live customer service agent could have to pay: In a few states, they'll also incur fees for going shopping with their card of about 25 cents per transaction. Not using the card doesn't come cheap either.

How Do Credit Card Issuers Make Money? - Credit Card InsiderTo avoid these fees, experts say state residents who have bank accounts should consider getting their unemployment benefits without a prepaid card. Most states will directly deposit the benefits into recipients' bank accounts upon request, says Saunders. Or, if they receive their benefits on a prepaid card, they can consider transferring that money to their bank account though some cards charge for that too she says.

The banking industry says consumers can avoid many of the fees that accompany the prepaid cards. Bank, which issues 10 states' prepaid unemployment cards. Prepaid cards are often pitched to consumers who may not otherwise qualify for a credit card.

But what the ads and promotions often don't mention is that using a prepaid card has no effect whatsoever on your credit score. Unlike credit cards, consumers' activity on prepaid cards is not reported to the three major credit bureaus -- Equifax, Experian and TransUnion -- and does not appear on credit reports issued by those companies.

It's the information in those credit reports that determines a consumer's FICO score, which is the credit score most lenders review when deciding whether to approve a borrower for a loan and at what terms, says John Ulzheimer, president of consumer education at SmartCredit.

Suze Orman says her prepaid card could change all that because her goal is for prepaid card transaction data to be included on credit reports. Orman's card has partnered up with TransUnion. In her conference call last month presenting the card, Orman said the bureau will evaluate how cardholders manage the card. That doesn't mean much for consumers using the card now.

TransUnion will do the evaluation over the next year and a half to two years to determine the impact it could have on a consumer's credit profile, says Colleen Tunney-Ryan, a TransUnion spokeswoman.

Meanwhile, RushCards reports regular bill payments made with its prepaid cards to PRBC, a lesser-known credit reporting agency whose reports are used by relatively few lenders.

RushCard's CEO Rosenblatt says the company is trying to forge relationships with the larger credit bureaus. Fans of prepaid cards say they can be a better deal than checking accounts -- especially these days when banks are upping checking account fees. But many checking accounts are still more affordable than prepaid cards, says Ulzheimer. And there are accounts that don't require large balances to get good deals: At ING Direct and Charles Schwab Bank, for instance, there is no minimum balance required to avoid a so-called maintenance fee.

Separately, checking accounts can be more convenient to use than prepaid cards, says Odysseas Papadimitriou, chief executive at CardHub. With checking accounts, consumers can pay their bills online but that's not always the case with prepaid cards. The American Express prepaid card and the Mango prepaid card don't have this feature, but both companies say they're looking at including it this year.

Mango says it used to feature bill pay and is working on reintroducing it. Depositing money onto a prepaid card can also get tricky. With a debit card, cardholders can deposit cash at their bank or in their bank's ATM.

Prepaid Debit Cards | Credit Cards | Mastercard

But in most cases with prepaid cards, consumers will need to either set up direct deposit, transfer money from an existing bank account or use PayPal. If cardholders want to deposit cash, they will often pay a fee for that service.

Prepaid card issuers say their cards can be a better deal than debit cards and checking accounts for some consumers.

For all their pitfalls, at least two prepaid cards stand out by offering a perk that's almost impossible to find elsewhere now: But to earn this interest, consumers will need to strategize. The fees include 50 cents for cardholders to check their balance once every three months to avoid a maintenance fee for inactivity. Both companies say they're focused on providing alternative banking solutions to consumers that go beyond prepaid cards.

When consumers stash their money in a bank account, their money is insured by the Federal Deposit Insurance Corporation. But don't assume that every prepaid card offers this guarantee. When consumers load money onto a prepaid card, some issuers stash those funds in a bank account, and in those cases consumers' money is often FDIC insured. But if a card issuer that doesn't meet FDIC insurance requirements shuts down, it will be up to the bankruptcy courts to decide if cardholders will get all or some of their money back, says Papadimitriou.

American Express' prepaid card doesn't offer FDIC protection but if a card is stolen or lost it will replace funds on a new card at no cost, says a spokeswoman. Also, funds on the so-called MoneyPak, a card-like product that consumers can use to load cash on prepaid cards, are not FDIC insured. That's because MoneyPak isn't a bank account, says Liz Brady, a spokeswoman for Green Dot, which owns MoneyPak.

They then use it to load the funds onto their prepaid card. Brady recommends transferring funds from MoneyPak onto prepaid cards as quickly as possible. Consumer protections against abusive credit-card practices have ramped up during the past few years in large part due to the CARD Act.

This legislation, which was signed into law in May , limits the fees credit-card issuers can charge, among other things. Prepaid cards, however, were not included in this law, which is partly why there aren't any official limits on the fees they charge, says Ulzheimer. On top of that, the federal consumer protections in place for credit and debit card fraud aren't required for prepaid cards, say experts. If a prepaid card is stolen, the cardholder may be hard pressed to get that money back.

It's up to each card issuer to decide if it wants to offer theft protection, says Jean Ann Fox, director of financial services for the Consumer Federation of America. Thankfully, some prepaid issuers have stepped to the plate. American Express and MasterCard, for instance, replace funds at no cost if a prepaid card is stolen or fraudulently used.

In response to concerns that prepaid card issuers were not disclosing all their fees, the Florida Attorney General's office launched an investigation last May into five prepaid card companies -- First Data Corp, Green Dot Corp, Account Now, NetSpend and UniRush Financial Services.

The investigation is looking into allegations of possible deceptive practices, says Florida Attorney General's office spokeswoman Jennifer Meale. Some companies, says Meale, may have been falsely claiming that their prepaid cards could help improve cardholders' credit scores, which isn't true.

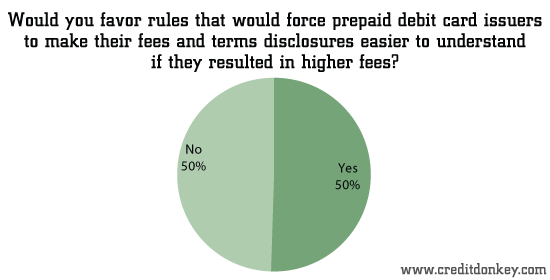

The federal government is starting to take a closer look at prepaid cards as well. A Senate bill entitled "Prepaid Card Consumer Protection Act of " was introduced in December and would require card issuers to provide more fee disclosure, among other things.

The bill is awaiting review by a Senate committee. The companies say they've been clear with consumers about their fees. Steve Streit, CEO of Green Dot Corporation, says that the company's fees are all disclosed on their cards' retail packaging that consumers can view before purchase as well as on its web site and the cardholder agreement that accompanies the card. UniRush CEO Rob Rosenblatt says the claims made by the Florida attorney general are "without merit," adding that the company ensures all fees are fair and transparent.

NetSpend spokeswoman Krista Shepard says the company complies with the law. Account Now declined to comment. Many prepaid card issuers tout discounts and freebies that consumers can get without signing up for the card.

For example, consumers who sign up for Suze Orman's prepaid card can receive their TransUnion credit report and credit score for free on a daily basis for one year. But it's easy to get that information for free without becoming a card holder.

10 Things Prepaid Card Issuers Won't Tell You - MarketWatch

Gardner, the card's spokeswoman, says its main focus is to give consumers access to plastic for everyday spending and bill pay and that the credit score and report are added features. That prescription card is administered by HealthTrans, a health care management services provider. But consumers can easily sign up for the prescription drug card on the company's PathtoBetterCare site. RushCard CEO Rosenblatt confirms that consumers can get this prescription discount card even if they don't have the prepaid card.

By using this site you agree to the Terms of Service , Privacy Policy , and Cookie Policy. Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information. All quotes are in local exchange time. Real-time last sale data for U.

Intraday data delayed at least 15 minutes or per exchange requirements. ET Drug stocks surge on report that President Trump plans to ease industry regulations. Updated FTSE ends lower as oil prices fall, pound climbs on rate-hike hopes. Updated Gold prices rise from 5-week lows as dollar eases. FBI Gives Details About Congressional Baseball Shooter. Tesla hires AI expert to help lead team in charge of self-driving software. This is what siblings argue about when it comes to money.

Updated Why Karen Handel — and President Trump — won and Jon Ossoff lost Georgia congressional race. Diageo deal for Casamigos expected to close in 2nd-half Diageo to buy George Clooney brand tequila Casamigos. Argentine peso hits record low against U. Dashcam Footage of Philando Castile Shooting.

How Much Do You Love Your iPhone? These stocks may be ready to pick up the bullish baton from techs. Cozying up to consumers in the face of competition from Adidas, Under Armour.

Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last?

Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar. My MarketWatch Watchlist Alerts Games Log In. Bulletin Diageo to acquire George Clooney tequila brand in billion-dollar deal. Home 10 Things Get email alerts. Also See 10 Things Start-Ups Won't Tell You 10 Things Electronics Retailers Won't Say 10 Things Customer-Service Reps Won't Tell You.

Pre-Paid Cards: Banks' New BFF, But Consumers Should be Leery | Fox Business

More Coverage Saudi Arabia replaces crown prince in major shakeup Stock market struggles to return to record territory These stocks may be ready to pick up the bullish baton from techs. We Want to Hear from You Join the conversation Comment. MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ.