Stock market pe ratios

RetireMentors features retirement advice from financial professionals, not staff journalists. Droms is the co-founder and co-chairman of Droms Strauss Advisors, Inc. He also is the John J. Professor of Finance in the McDonough School of Business at Georgetown University, where he teaches investments in the undergraduate and MBA programs.

Bill is a graduate of Brown University, holds a Master's and Doctorate in Business Administration from George Washington University and is a CFA charter holder. He is the author or co-author of several books on investments, including Investment Fundamentals, The Dow Jones-Irwin Guide to Personal Financial Planning, The Dow Jones-Irwin Mutual Fund Yearbook, and The Life Insurance Investment Advisor.

You can e-mail bill at bill droms-strauss. Follow Bill on Twitter at Wdroms. Now that we all or most of us, anyway have settled in with the election results, it is pretty fascinating to look back at the market action during the fourth quarter of the year: Since then we have seen a succession of new highs on both indexes, vaguely reminiscent of the tech bubble of the late nineties when one prescient observer noted that the market discounts the future, but at that time, appeared to be discounting the hereafter as well.

Except, maybe it really is different this time.

A reasonable take on the U. This is the normal ratio based on trailing twelve month's TTM earnings, not the usually lower ratio based on an estimate of "forward" or forecasted future 12 month's earnings. Given the difficulties of forecasting future earnings, and ignoring the illusory precision of calculations based on past earnings "as reported" in corporate annual reports, let's stick to the facts of actual reported earnings for the previous 12 months.

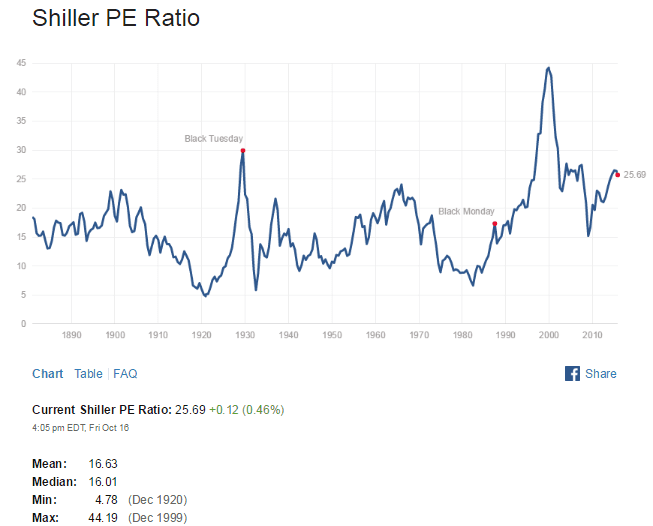

Readers of the financial press may now ask: The very long-run average since of the Shiller PE is The post-World War II Shiller PE average is However, the current level of the Shiller PE at Surely this observation should give one pause — except, the Shiller PE has been above "average" for most of the last 25 years. In fact, it has been below average only once since in the year of the credit crisis crash. So now we pause to consider the impact of very low interest rates on stock valuations and the further impact of inevitably rising interest rates next year on stock valuations.

A seemingly benign idea called the "Fed Model" has attracted some controversy over the years as to the validity of the model for a concise academic discussion, one may read an NBER working paper from entitled "Inflation and the Stock Market: Understanding the 'Fed Model'".

The "theory" behind this, if it is in fact a theory, is that if the year bond yield is say 2. So, based on the Fed model, the current extremely low interest rate environment flows through to higher multiples for stock earnings. This approach, to me at least, has some intuitive appeal: Of course, interest rates are nearly certain to go up over the next few years and increased rates should flow through to the Fed Model PE ratio.

If the year rate goes to 4. A PE of 25 thus may be seen as definitely pricey compared to historical averages, but perhaps justified by the current era of very low interest rates.

One thing we do know, however, is that the current level of PE ratios, whether TTM, forward or Shiller, has been shown to be a poor guide to market timing. This knowledge brings us back to the "old time religion" — buying and holding a diversified portfolio commensurate with your personal risk tolerance is the best defense against uncertain markets.

By using this site you agree to the Terms of Service , Privacy Policy , and Cookie Policy. Intraday Data provided by SIX Financial Information and subject to terms of use. Historical and current end-of-day data provided by SIX Financial Information.

All quotes are in local exchange time. Real-time last sale data for U. Intraday data delayed at least 15 minutes or per exchange requirements.

ET Updated Gold prices rise from 5-week lows as dollar eases. FBI Gives Details About Congressional Baseball Shooter. Tesla hires AI expert to help lead team in charge of self-driving software. This is what siblings argue about when it comes to money. Updated Why Karen Handel — and President Trump — won and Jon Ossoff lost Georgia congressional race.

Diageo deal for Casamigos expected to close in 2nd-half Diageo to buy George Clooney brand tequila Casamigos. Argentine peso hits record low against U. Dashcam Footage of Philando Castile Shooting.

P/Es & Yields on Major Indexes - Markets Data Center - ucujaluxu.web.fc2.com

How Much Do You Love Your iPhone? These stocks may be ready to pick up the bullish baton from techs. Cozying up to consumers in the face of competition from Adidas, Under Armour. When should you convert to a Roth IRA? Breaking Argentine peso hits record low against U.

S&P PE Ratio

Home News Viewer Video SectorWatch Podcasts First Take Games Portfolio My MarketWatch. Retirement Retire Here, Not There Encore Taxes How-to Guides Social Security Estate Planning Events Columns Robert Powell's Retirement Portfolio Andrea Coombes's Working Retirement Tools Retirement Planner How long will my money last? Economy Federal Reserve Capitol Report Economic Report Columns Darrell Delamaide Rex Nutting Tools Economic Calendar.

My MarketWatch Watchlist Alerts Games Log In. Bulletin Diageo to acquire George Clooney tequila brand in billion-dollar deal. Retire Mentors Powered by RetireMentors features retirement advice from financial professionals, not staff journalists. Is the stock market overpriced?

More from MarketWatch Avoid these chemicals found in everything from shampoo to kitchen counters: We Want to Hear from You Join the conversation Comment.

MarketWatch Site Index Topics Help Feedback Newsroom Roster Media Archive Premium Products Mobile. Dow Jones Network WSJ. Dow Jones Industrial Average DJ-Index: