How to find preferred stock par value

How to Calculate Par Value in Financial Accounting | The Finance Base

July 18, By Yokum 10 Comments. Par value is the minimum price per share that shares must be issued for in order to be fully paid. Some states, like California, allow for no par value shares.

If no par value is selected, I am assuming that the company sets the par value in the resolutions. Must there be a stated authorized share capital in the articles of incorporation if there is no par value for a CA corporation? Having no par value shares results in franchise tax being calculated on an authorized shares basis in Delaware, which may be higher than the assumed par value capital method, which takes into account total gross assets and generally results in a significantly lower tax calculation.

If the founder of a company purchases founder's shares at par value and then forex trading lowest deposit, the company proceeds to become publicly traded through a Direct Public Offering, does the company or founder stand any risk of litigation from shareholders purchasing shares at a much higher although discounted price through a private placement offering and then td ameritrade stock trade cost realize later that the how to find preferred stock par value only paid par value for the founder's shares?

LD — depends on the facts. If how to find preferred stock par value value at incorporation was nominal, and substantial value was created by the time of later stock issuances at higher prices, then nothing seems particularly unusual about the facts.

This is exactly what every typical venture-backed startup company does. Obviously, if the founder stock was issued very close in time to other securities issuances at higher prices, then the investors may have paid too much for their shares or the founder may have paid too little. And then, once the corporation is established, the founders can then make a loan to the company for which they can be reimbursed.

How to Calculate the Cash Dividend Using Preferred Stock Market Value | ucujaluxu.web.fc2.com

Just trying to make sure I understand it all…thanks! Founders can loan money to the company. If you set a zero par value there can alternative franchise taxes that a state can levy.

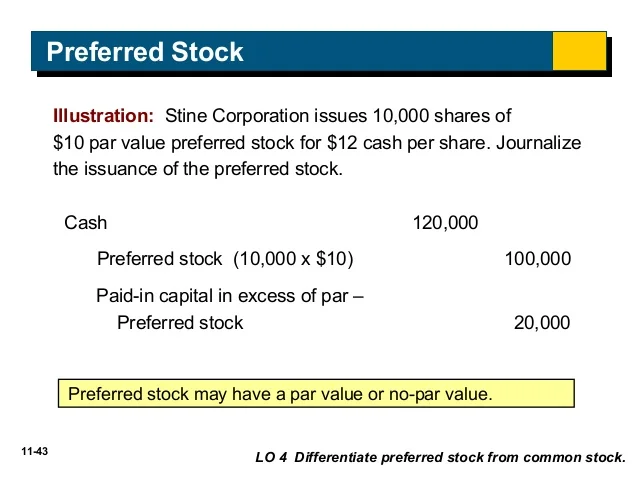

Valuation Of A Preferred Stock

This true for DE. Index About Yokum Disclaimer Privacy Policy Contact Yokum FAQs. J — The articles will either provide for a par value or no par value. A little nuance in setting par value: