Short term investment in indian stock market

Never miss a great news story!

Get instant notifications from Economic Times Allow Not now. Choose your reason below and click on the Report button.

This will alert our moderators to take action. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings.

ET APPS ET Android App ET iPhone App ET iPad App ET Wealth Android App ET Blackberry App ET Nokia App ET Markets Android App ET Markets iPhone App ET Money Android App. FOLLOW US FACEBOOK TWITTER YOUTUBE LINKEDIN GOOGLE PLUS RSS. LATEST NEWS Thales, Reliance Defence seal deal for joint venture. Home Markets News Industry Small Biz Politics Wealth MF Tech.

Jobs Opinion Blogs NRI Magazines Slideshows ET NOW ET Speed ET Portfolio. Real Estate RERA and You.

4 short-term strategies for investing in stocks - Rediff Getahead

Calculators IFSC Bank Code New Invoice Generator EPF Calculator House Property Income HRA Calculator Sukanya Samriddhi Calculator Education Loan Calculator Car Loan Calculator Home Loan Calculator Personal Loan Calculator Risk Tolerance Calculator Financial Fitness Calculator Tax Impact Calculator Homeloan Refinance Calculator Retirement Savings Calculator.

NIFTY 50 9, Select Portfolio and Asset Combination for Display on Market Band. Download ET MARKETS APP. Drag according to your convenience. Investors should commit money systematically over the next six months to earn well after 3 years. Experts say will be a tough year for Indian equities because of global and domestic headwinds. While interest rate hikes by the US Federal Reserve is the biggest global factor, a short-term slowdown triggered by demonetisation and a possible delay in GST rollout are the domestic drawbacks.

So should investors wait and watch or make the most of the situation? With the focus shifting from emerging markets to developed markets like the US, foreign portfolio investors FPIs have started reducing their exposure to Indian equity. Top multi-caps have given big returns AUM as on 30 Nov.

Complied by ETIG Database Sorted on the basis of 10 year returns For instance, FPIs have withdrawn Rs 29, crore in the last three months.

However, the equity market did not crash despite that as an inflow of Rs 29, crore from domestic institutional investors saved the day. However, domestic inflows may dry up if the stock market remains subdued for some more time.

Today's Stock Market Recommendation, Stock Call, Stock Pick, BSE, NSE | Business Line

This is because most retail investors usually chase returns and invest more when historical returns are high. They withdraw when historical returns are low or negative. The stock market has not generated great returns in the last decade and this has begun testing the patience of long-term investors.

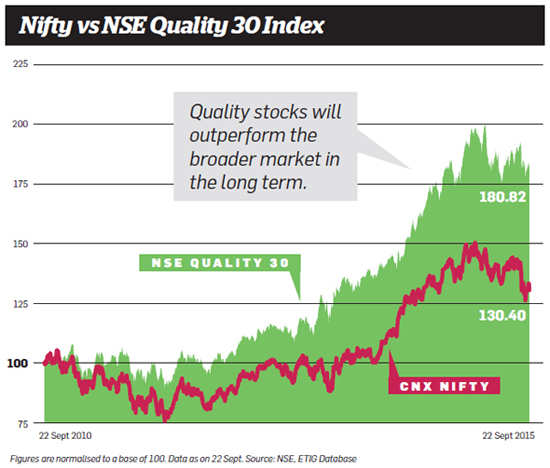

According to the latest figures, the Sensex has only generated 6. Sensex's year rolling return is only 6. BSE India The performance in the last nine years, especially after the peak, is worse and the 9-year CAGR on the Sensex is just 2. That means if the Sensex continues to remain subdued, the year rolling return will come down further.

Instead of chasing returns, investors should treat these low return periods as investment opportunities. Historically, Indian markets have provided fabulous returns when its long-term historical returns have been low like in when even the year SIP was generating negative returns and very low returns when its long term historical returns were high and So can one expect high returns from current levels in the long-term?

Experts call this phenomenon 'mean reversal' because the historical returns are nothing but the average of these spikes and low return periods. So when will the next spike happen?

Slow growth in corporate profit is one reason why experts are not able to predict the next up move. High marketwide valuation is another concern. What should investors do? Since it is difficult to identify the ultimate bottom, spreading investments over the year is a good idea.

How should retail investors go about this? Since managing direct equities is difficult,most experts suggest taking the institutional route.

Error (Forbidden)

Identify two or three good managers and give money to them," says Agrawal. There is no purpose in going with sectoral funds with long-term money. Even after decided on a diversified mutual fund route, should one go with large-cap or mid-cap funds? There will be periods of large-cap outperforming mid-cap and vice versa, but let the fund manager take that call," says Narasimhan.

As visible from the table, the top performing multi-cap funds have generated fabulous returns in the last 10 years. Living and entertainment Timescity iDiva Zoom Luxpresso Gaana Happytrips Cricbuzz Get Smartapp Networking itimes MensXP.

Hot on the Web UBER OnePlus 5 Top 10 mutual funds GST Sensex Gold rate today Sensex Today. Services ads2book Gadgetsnow Free Business Listings Simplymarry Astrospeak Timesjobs Magicbricks Zigwheels Timesdeal dineout Filmipop Remit2india Gaana Greetzap Techradar Alivear Google Play Manage Notifications. Digg Google Bookmarks StumbleUpon Reddit Newsvine Live Bookmarks Technorati Yahoo Bookmarks Blogmarks Del. My Saved Articles Sign in Sign up.

How to Invest in Stock Market - Long Term and Short Term?

Find this comment offensive? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

SHORT TERM IN STOCK MARKET PART 1(SAFE METHODS FOR BUSY & LAZY)Your Reason has been Reported to the admin. Fill in your details: Will be displayed Will not be displayed Will be displayed.