Irs covered call options

Make it inline block later.

Premium Advice MY SERVICES None OTHER SERVICES. MENU Latest Stock Picks Stocks Scorecards News Investing News Fool Podcasts Guides Investing Retirement Personal Finance Motley Fool Answers Find a Broker Community Discussion Boards CAPS More About Help Settings My Fool My Fool My Profile My Watchlist My Scorecard My Boards My CAPS My Reports My Subscriptions My Settings Help Fool Answers Contact Us Login Search.

UnThreaded Threaded Whole Thread 10 Ignore Thread. Post New Post Reply Reply Later Create Poll. Report Post Recommend it! Tax Implications of Covered Calls for Investors In my wanderings through the web two things have become clear to me.

I hope to make a dent in this deficiency through this and, possibly, future posts. Other than believing I am somewhat articulate, I have no qualifications for this task.

I am not a tax professional. I cannot guarantee my interpretation of any fact will match that of the IRS or any of its employees. I will ask certain more qualified individuals to review this article and comment upon it, although they are under no obligation to do so. Given the time of year I suspect they are quite busy. Eventually I hope they will have the time and inclination to supply more information on the tax implications of options strategies, but I will not be holding my breath.

Until the Treasury Department clarifies some of the issues involved, it will be nearly impossible to supply meaningful answers to certain questions.

In this post I am only addressing "simple" covered calls written against stock owned by an investor. This information does not apply to traders and dealers, to calls covered by anything other than the underlying stock, or to covered calls that are part of an option strategy that includes other stock or option positions, such as a strangle.

The following factors may impact the tax consequences of selling covered calls: To determine this you need to determine if selling the options "substantially reduces any risk of loss you may have from holding" the stock. Covered calls are presumed to be substantial by the IRS, but you may determine that they are not in a particular case and present your argument to the IRS. To determine this the IRS has very specific and detailed instructions in Publication In the edition they are located on page If a stock price is falling, and you want to sell an out-of-the-money call, be sure you use a strike price is more than the previous closing price.

If a stock closed at 50, then opened the next day at 40, a call with a strike price of 45 would be considered in-the-money by the IRS. The call will be qualified if a there are more than 30 days until expiration at the time the call is sold and b the option is not deep-in-the-money, as defined in Publication General rules applicable to all covered calls: The taxable event occurs when the short position is closed.

Bing-Strategies-covered-options | Learn @ OptionsANIMAL

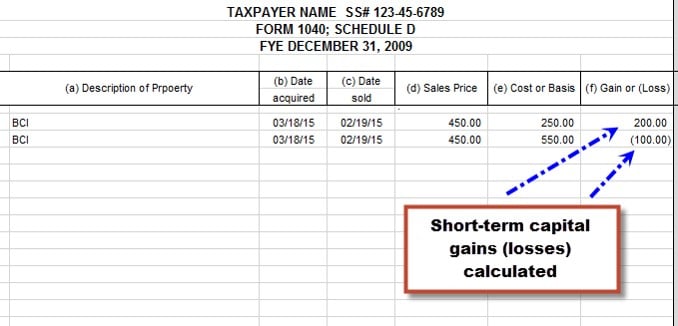

If you made a profit, it will be a short-term capital gain. If you had a loss, it will be a short-term capital loss unless there is an exception noted below. Rules applicable to specific covered calls: This rule applies if a you closed one of the positions sold the stock or bought back the options in one tax year for a loss and b in less than 30 days closed the other position for a gain in the next tax year.

If this rule applies you must defer your loss until the year you recognized the profit. Otherwise the tax implications are the same as for an out-of- the-money qualified covered call unless a you bought the option back for a loss and b you would have had a long- term capital gain or loss if you had sold the stock on the day you sold the option.

In this case, you would claim a long-term capital loss instead of a short-term capitol loss. If the option was deep-in-the-money when sold and you had an unrecognized gain on the stock at the time of the sale, there is a chance you may have also created a "constructive sale" of the stock by selling the option. From a tax viewpoint neither of these is likely to be beneficial to a taxpayer. Aside from extra paperwork, the primary implication of a straddle is that any losses you recognize cannot be claimed as long as they are offset by unrecognized gains in other related positions.

Another, sometimes more significant, implication of a straddle is that the holding period of the stock will be restarted when the straddle ends unless you held the stock more than one year before you established the straddle. The primary implication of a "constructive sale" is that you will be taxed as if you had sold and repurchased the stock at the time you sold the option.

Both straddles and constructive sales are discussed in some detail in IRS Publication Other Rules 1 If a "related party" has a long or short position in the same stock, or an option on the same stock, you may have to make some adjustments to your return to reflect that ownership. It is clear that a constructive sale was intended if the call option is sufficiently in the money to eliminate substantially all of the risk of loss and opportunity for income and gain.

If there is a substantial risk of loss, or a substantial opportunity for gain, a constructive sale was not intended. Until Treasury regulations are issued no one can tell you where to draw the line. Similarly, there are no definitive guidelines to determine when an option position is "substantially identical" to another position and can invoke the wash sale rule.

Consequently, if you owned 1, shares of a stock purchased at different times and prices and sold five calls expiring in 25 days, the implications are not defined.

Would the straddle consist of 1, shares of stock and five call options, or shares and five call options? If only shares were included, which shares would it be? Due to splits, mergers, and FLEX options it is possible that there may be nonstandard strike prices for a particular stock. When determining the "lowest qualified benchmark" LQB to determine it an in-the-money call is qualified, it is not totally clear if you have to consider these nonstandard strike prices.

Until there is some clarification from the IRS the regulations, as written, imply they should be included. As a result, if you sell two options with identical strike prices on two stocks with identical price quotes, one may be qualified and the other not qualified.

Observations 1 I have several times heard people say they were told premiums you received from covered calls were not taxable until the underlying stock was sold.

I don't care whether you heard it from your broker, your father, your minister, your CPA or your cocker spaniel, IT IS NOT TRUE. Since there are frequently less than 30 days between the third Fridays of two consecutive months, this strategy will generate straddles. If you plan to hold the stock for over a year to achieve long-term capital gains status, such sales will defeat your plan.

Covered Call Tax Treatment | Our Everyday Life

If the opening price is greater use it as the applicable stock price, otherwise use the closing price. If the strike price is equal to the LQB or between the LQB and the applicable stock price it is considered in-the-money but not deep-in-the-money.

Announcements What was Your Dumbest Investment? Share it with us -- and learn from others' stories of flubs. When Life Gives You Lemons We all have had hardships and made poor decisions. The important thing is how we respond and grow. Read the story of a Fool who started from nothing, and looks to gain everything. Community Home Speak Your Mind, Start Your Blog, Rate Your Stocks Community Team Fools - who are those TMF's? Contact Us Contact Customer Service and other Fool departments here. Winner of the Washingtonian great places to work, and Glassdoor 1 Company to Work For !

Have access to all of TMF's online and email products for FREE, and be paid for your contributions to TMF! Click the link and start your Fool career.