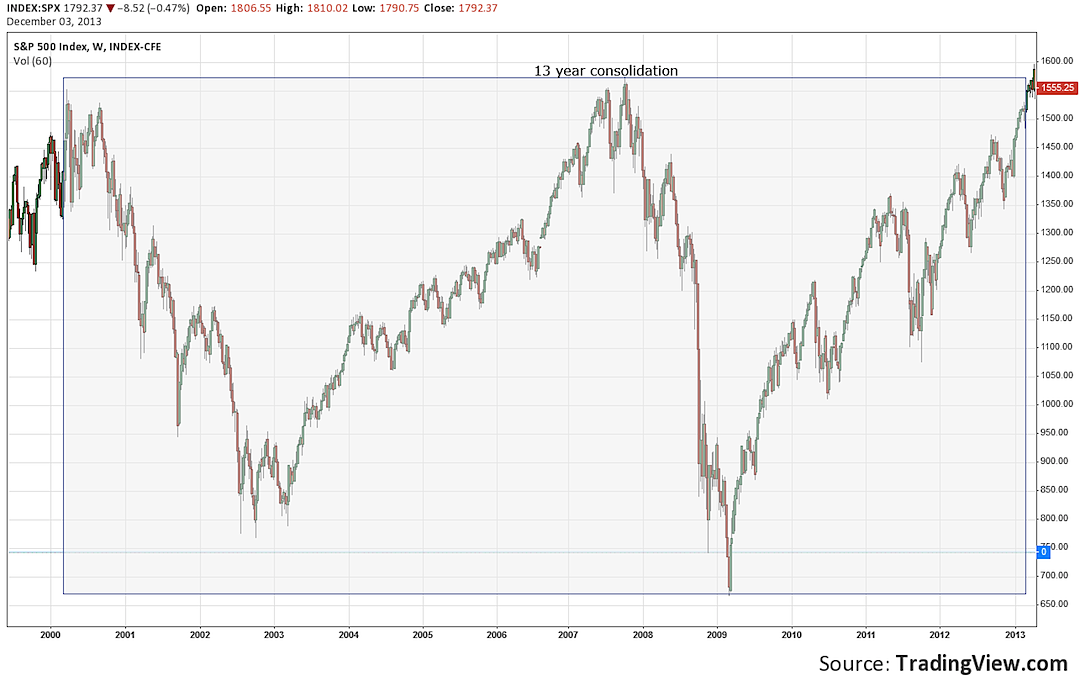

Consolidation of stock markets

Consolidation is used in technical analysis to describe the movement of a stock's price within a well-defined pattern of trading levels.

Consolidation is generally regarded as a period of indecision, which ends when the price of the asset moves above or below the prices in the trading pattern.

Consolidation is also defined as a set of financial statements that presents a parent and a subsidiary company as one company. Technical traders look for support and resistance levels in price charts, and traders use those levels to make buy and sell decisions. The upper and lower bounds of the stock's price create the levels of resistance and support within the consolidation. A resistance level is the top end of the price pattern, while the support level is the lower end of the pattern.

Once the price of the stock breaks through the identified areas of support or resistance, volatility quickly increases, and so does the opportunity for short-term traders to generate a profit. Technical traders believe that a breakout above the resistance price means that stock price is increasing further, so the trader buys the pivot trading software forex 15 minutes. On the other hand, a breakout below the support level indicates that the stock price is moving even lower, and the trader sells the stock.

Analysts and other stakeholders use consolidated financial statements, which present a parent and a subsidiary company as one combined company.

A parent company buys a majority ownership percentage of a subsidiary company, and a non-controlling interest NCI purchases the remainder of the firm. In some cases, the parent buys the entire subsidiary company, which means that no other firm has ownership. To create consolidated financial profitable projects with binary options systems, the assets and liabilities of the subsidiary are adjusted to fair market value, and those work from home ml3 are used in the combined financial statements.

If the parent and NCI pay more than the fair market value of the net assets assets less liabilities consolidation of stock markets, the excess amount is posted a goodwill asset account, and goodwill is moved into an expense account over time.

How do I identify a stock that is under consolidation? | Investopedia

A consolidation eliminates any transactions between the parent and subsidiary, or between the subsidiary and the NCI. The consolidated financials only includes transactions with third parties, and each of the companies continues to produce separate financial statements.

Stock Markets Ready For ConsolidationDictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Markets News, Headlines and Video - CBS News

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Non-Controlling Interest Consolidate Fair Value Unconsolidated Subsidiary Affiliated Group Breakout Trader Business Consolidation Subsidiary Buy Break.

TSX Venture

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.