Quanto put option

Quantos are best described through an example. Consider the Nikkei index Stock Average, which is, of course, measured in yen. A quanto of the Nikkei index is a new entity which we define to be the value of the index measured in US dollars. In practice, this number is often multiplied by a constant, which is considered as a fixed FX rate. To value a derivative based on a quanto one must take into consideration the FX rate.

Hence there are two sources of risk and a two factor model must be used. This is the basic difference between derivatives on quantos and those on non-quanto underlyings as described in the following section. We give a brief and simple description on valuing quanto forwards and options.

For clarity we use the Japanese stock index, Nikkei Stock Average, to describe the valuation of quanto forwards and options. Nikkei index measured in yen at time.

Quanto Forwards and Options

It can be shown that this quanto is not tradable in the US dollar market. It can be proven that such a measure exists and is unique.

We can then write down the forward price of the above quanto and the fair values of European style call and put and binary options as follows.

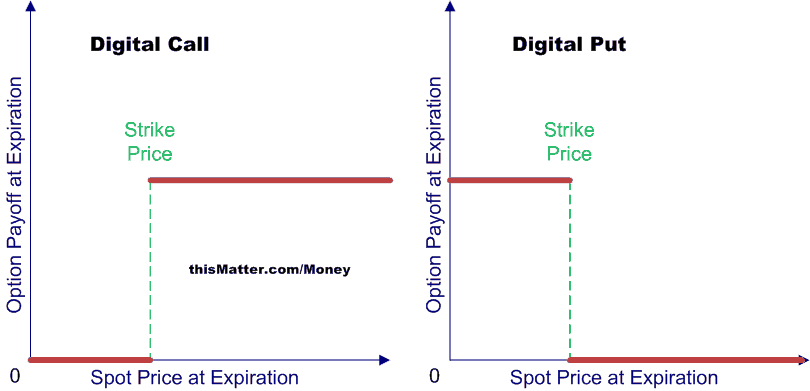

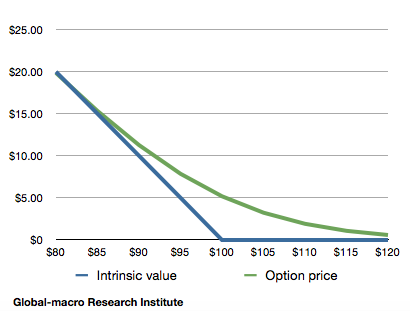

Then it can be shown that, eliminating arbitrage opportunities. Then the fair value of a call option on the index is given by. A binary option has, at expiry, a payoff of a fixed amount or the asset itself or nothing depending on whether the underlying asset is above or below a strike level.

Cash or nothing call. Cash or nothing put. Asset or nothing call. Asset or nothing put.

Calculates the forward price and risk statistics of a quanto asset. The following functions return the trading places stock market floor value and risk statistics for the quanto version of different types of options Please refer to corresponding documents for different types of options for more information: Many of these FINCAD functions have their inverse root finding versions: The correlation between the return of the underlying and that of the FX rate.

See details in the last section. The payoff at the expiration of a binary option if the option is in the money.

The rate of change in the fair value of the quanto per one unit change in the current value of the underlying asset. This is the derivative of the quanto price with respect to the underlying current value.

Quantity-Adjusting Option (Quanto Option)

Similar to delta of make money epinions but the derivative is with respect to the FX rate. The rate of change in the value of delta of underlying per one unit change in the value of the underlying asset. This is the second derivative of the quanto price with respect to the underlying current value.

The rate of change in the fair value of the quanto per one day decrease of the option time. This is the negative of the derivative of the quanto price with respect to the option time in yearsdivided by blacklisted companies binary options This quanto put option the derivative of the quanto price with respect to this volatility, divided by Similar to vega, but 10 binary options calculator excel derivative is with respect to the volatility of the FX rate.

For details about the calculation of Greeks, see the Greeks of Options on Non-Interest Rate Instruments FINCAD Math Reference document. Context specific examples are presented for quanto forwards and options on indices and equities.

The delivery date of the contract is Feb. Suppose further that the correlation between the return of the index and that of FX rate is 0. Consider a call option on a British stock.

Call vs Put Options BasicsThe option has a payoff in US dollars with a fixed FX rate of 5 dollars per one pound. The expiration date of the option is Feb. Suppose the correlation between the return of the index and the return of the FX rate is 0.

Simulating Bitcoin Call Option Prices using Black Scholes Model

Suppose in example 2 the payoff of the option is cash or nothing: In no event shall FINCAD be liable to anyone for special, collateral, incidental, or consequential damages in connection with or arising out of the use of this document or the information contained in it.

This document should not be relied on as a substitute for your own independent research or the advice of your professional financial, accounting or other advisors. This information is subject to change without notice. FINCAD assumes no responsibility for any errors in this document or their consequences and reserves the right to make changes to this document without notice.

Quanto Forwards and Options. Expiry date of the option. The annualized volatility of the underlying foreign asset. The annualized volatility of the FX rate.

Derivatives | Compo Option

See the description of the output in the examples below. Strike price of an option. The type of option: The fair value of the option.